Despite reporting a 13.1% dip in pre-tax profits to £17.3 million for the half to June, sausage skins maker Devro (DVO) advances 1.7% to 311.7p. With the bad news already digested, investors are focused on the improving second half as well as the £505 million cap's ambitious plans for China and the US.

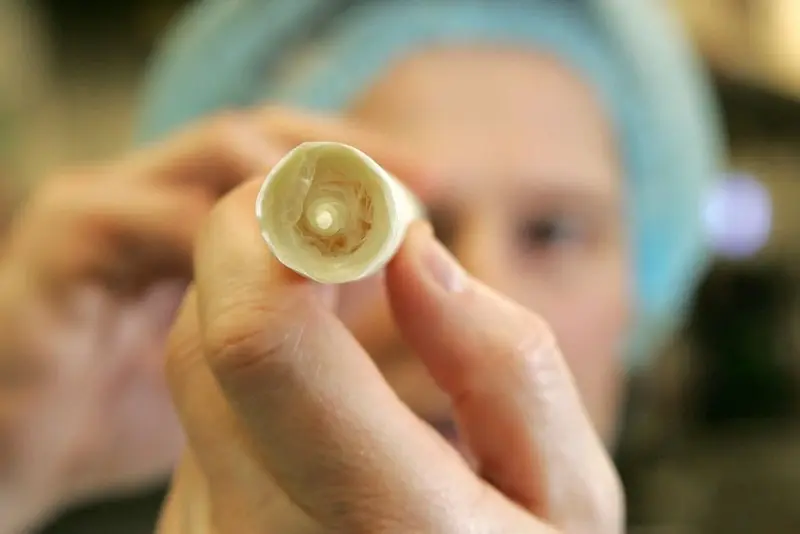

One of the world's leading manufacturers of collagen products for the food industry, the Glasgow-headquartered group's figures are in line with a recent (24 June) profits warning which sent the shares south. This flagged a £3 million first-half profits decline caused by slower April and May sales, hide cost increases and temporary US manufacturing issues.

In the face of these trials, Devro still grew its top line 3.1% to £118.9 million, as success with price increases to recover elevated input costs combined with strong demand in emerging markets including Latin America, Russia, South East Asia and China. Chief executive officer Peter Page insists the global market for collagen casing continues to expand with economic growth and urbanisation driving increased meat consumption in emerging markets.

Developed markets proved an uphill struggle, with Southern Europe weak and edible collagen volumes declining in Western Europe amid lower retail food volumes and cold weather, which delayed the start of the bratwurst grilling season. Nevertheless, Devro is well placed to profit from gut conversion to collagen casing in developed economies. Volumes of Select, its premium product range designed to displace expensive sheep gut, grew 4.4% globally, driven by progress in Germany and Japan and the product now accounts for 8.5% of the top line.

Page remains 'confident of a strong second half and growth in full-year earnings', having seen 'a fair pick up in trading in June and July'. Furthermore, yield and productivity issues at the firm's ageing South Carolina plant have been fixed, while hide costs aren't expected to rise significantly in the second half of the year. Extra capacity from a £25 million investment in the Czech Republic will come on stream in August, one month earlier than anticipated, in a move that will also reduce manufacturing costs.

Devro is also making progress in clarifying its investment plans with regard to the US where it intends to reinvest in its South Carolina plant over the next three years. With regards to China, Devro announces it is 'progressing with design and feasibility assessments' for its own manufacturing plant. Be in no doubt, the Peoples' Republic is a major prize for Devro, as the consumption of sausages is growing and disposable incomes are rising. Proliferation of premium sausage products in Chine should play strongly into the hands of the London-listed technical leader.

Comforted by today's statement, Investec Securities analyst Nicola Mallard is sticking with her 'buy' rating and 358p price target for Devro and leaves her forecasts unchanged. The food sector sage forecasts a modest 2.1% taxable profits increase to £43.1 million (2012: £42.2 million) for 2013 and earnings of 21.7p (20.7p), as well as an improved shareholder reward of 8.8p (2012: 8.5p). Next year, Mallard looks for £47.1 million profits, earnings of 23.7p and further dividend progression to 9.5p.