Cigarette filters-to-plastic components distributor Essentra (ESNT) continues its ascent under the leadership of Colin Day. The former Reckitt Benckiser (RB.) finance director has been chief executive of the FTSE 250 constituent, rebranded earlier this year from Filtrona at a £2.4 million cost, since 2011 and his efforts to drive up sales and make the group more efficient are clearly working. Today's interim results push the shares a further 2.2% ahead to 765.5p.

Pre-tax profit has risen by 14% to £45.4 million; the dividend's gone up 23% to 4.8p; and it looks like there's some more acquisitions on the verge of being announced.

Day's challenge immediately upon joining the business was to sweat the asset base and start growing sales. Analysts declared the CEO's efforts to be a 'text book case of what happens when new management meets a sleepily run company'.

In an interview with Shares last year (see Griller, 15 March '12), Day declared: 'I want more efficient operations and more volume through the plant. It is not just about waving a wand and saying we are going for growth. You need capacity which we have. When there's only 50% to 60% utilisation, you don't need more factories, you need more volumes.'

That's clearly been addressed as profit margins are going up, so too are sales. A key driver for the latter, admittedly, has been acquisitions. Day always intended to spend money to make money, so the net debt is rising, currently standing at £212 million. The company is comfortable with taking on further debt and reports numerous potential acquisition opportunities, from small bolt-on deals to companies that could be on the same scale as March's £160 million purchase of packaging group Contego Healthcare.

A £142 million placing to fund Contego's purchase was three times oversubscribed by investors. While that business is the cause of margin dilution in Essentra's packaging division, this is not cause for alarm. Day says it is expensive to buy companies with superior operating margins, so the strategy is to buy weaker ones, strip out costs and integrate them with the wider parent business to drive margins up. In Contego's case, it was producing approximately 15% operating margins pre-acquisition, versus just under 20% for Essentra's packaging operations. Interim results today show a 300 basis point drop in the division's margin to 17.6%. These are expected to recover in the second half of the year as Essentra has a few tricks up its sleeve to achieve 'significant cost savings'.

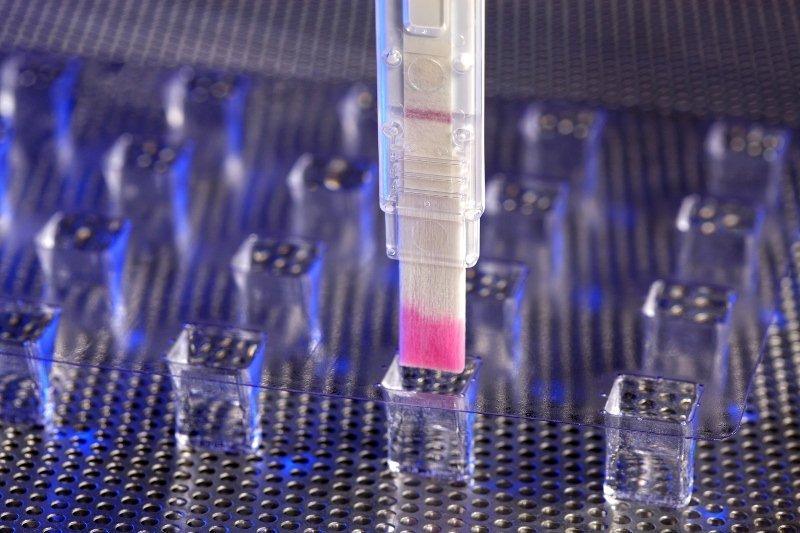

The cigarette filter division achieved 180 basis point margin improvement to 13.9%. It has a significant contract starting in the fourth quarter of 2013, its biggest contract win to date. So the half-year period just won actually includes extra cost to train staff ready for the big contract activity later this year. Therefore filters could also see much better margins by the financial year end.

Essentra, which is a running Shares Play of the Week (up 47% since we said to buy at 521p on 9 Aug '12), now says it has three main tasks. These are to get its acquired businesses fully integrated, improve working capital and 'keep the cash coming in'.

Deutsche Bank has an 808p price target. That looks perfectly achievable in the very near future given momentum in the business and the solid progress illustrated in today's results.