Just a single horizontal appraisal well is all that could stand between UK oil firm Hurricane Energy (HUR:AIM) and a full scale development of its 100%-owned Lancaster discovery west of Shetland.

Though the shares received a bump on the positive results (15 Sep) from analysis of the Lancaster well, at 40p they remain at a significant discount to Cenkos Securities? risked net asset value (NAV) per share of 157p. We think this discount will unwind as the company makes progress towards bringing Lancaster into production, further de-risking a total contingent resource of 450 million barrels across its Lancaster, Whirlwind, Typhoon and Lincoln assets.

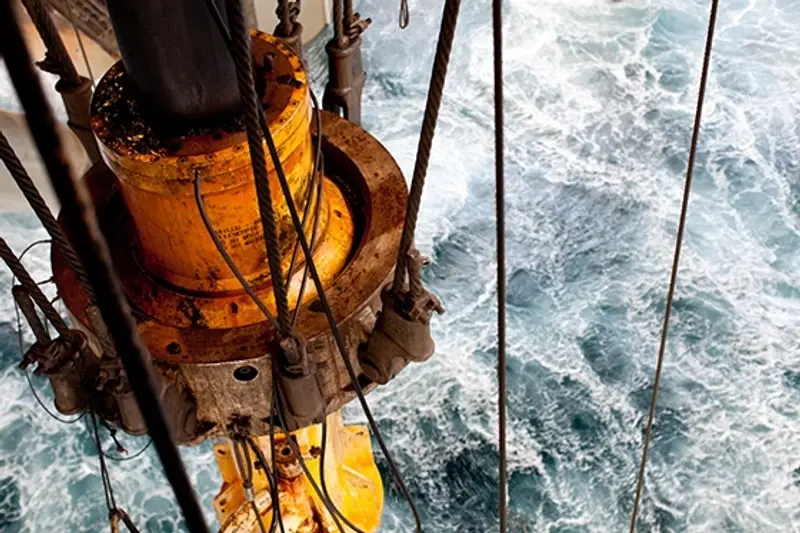

Hurricane is targeting fractured basement reservoirs - untapped plays located beneath the sandstones from which most of the UK?s oil has historically been produced. These reservoirs have been successfully exploited in countries like Yemen and Vietnam and the signs are encouraging of a repeat closer to home. Third party analysis suggests the Lancaster well could produce at rates of more than 20,000 barrels of per day (bopd) - five times the threshold for commercial output.

The results reveal a well productivity index (an indicator of production potential) of 160 bopd per pound per square inch. According to Cenkos this could mean reserves are recovered quicker and reduce operating costs, making the project more attractive in the eyes of any potential partner and allowing Hurricane to secure better terms.