Private investors will get a chance to participate in the stockmarket listing of Alton Towers-to-Legoland operator Merlin Entertainments. At least 20% of the business is being offered to new investors. Individuals must invest a minimum £1,000 to access the initial public offering (IPO) via financial intermediaries, principally stockbrokers. Precise details are expected to be published in the next few weeks.

As a sweetener to encourage retail investors in the IPO, Merlin is offering a 30% discount on either two adult Merlin annual passes or one family Merlin annual pass. We wouldn't get too excited about this shareholder perk as there's already a 25% discount available to the general public via its website.

Two annual passes normally cost £318, so IPO participants would pay £222.60 - saving £95.40. A family pass for four people costs £476 so the 30% discount takes it down to £333.20, slashing £142.80 off the bill.

That means IPO participants are only saving a mere £15.90 on the annual pass option or £23.80 for a family pass compared with the discount freely available to the public. Those savings would nearly be eaten up by share dealing costs.

Shareholder perks are always welcome, but don't let that be the reason why you want to invest in the company. You must purely focus on the business, its valuation, risks, quality of earnings and growth potential. Merlin is ultimately a play on consumer confidence and economic recovery in its core regions of the UK and Europe, as we discussed in this recent feature on IPOs.

Until there's an official price range for the IPO, we don't know if Merlin is worth an investment. But assuming its valuation isn't too lofty, there's certainly good reason to suggest it will do well on the stockmarket.

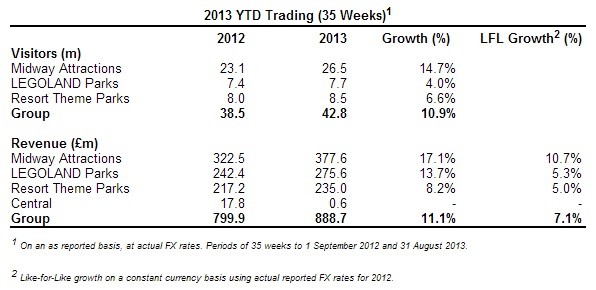

This table shows the year-to-date trading performance.

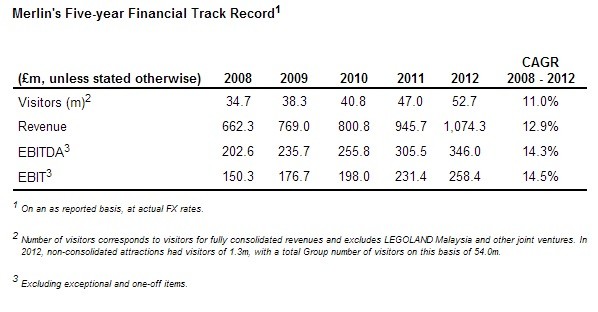

Here we have Merlin's five-year financial track record.

The business is expanding in places like Asia Pacific and North America. It plans to develop a Legoland park in Dubai, followed by a potential roll-out in Japan, South Korea and China. It currently operates 99 attractions in 22 countries and claims to be the second largest theme park operator in the world after Walt Disney.

Press reports suggest at least £3 billion market cap. Merlin is targeting 20% minimum free float, equal to £600 million of the business. Of this sum, £200 million will relate to cash raised through the issue of new shares. This money will help pay down debt and pay for costs of the share offer. Private equity owners Blackstone and CVC, Lego-owner KIRKBI and Merlin's management are also selling down part of their existing holding.

The leisure giant put off plans for a listing in 2010 due to volatile market conditions. The success of Royal Mail (RMG), Countrywide (CWD) and many other IPOs this year will no doubt have given Merlin renewed confidence.