If you fancy a bank holiday bet you could play 16 red on a roulette wheel, stick a tenner on an outside nag at Newmarket, or buy some shares in Pure Wafer (PUR:AIM). Today the silicon wafer recycler revealed that it has struck a deal with insurers after its Swansea plant was destroyed by fire in December. While the company is staying mum on the details, the bottom line is a likely special payout of somewhere between 60p and 125p.

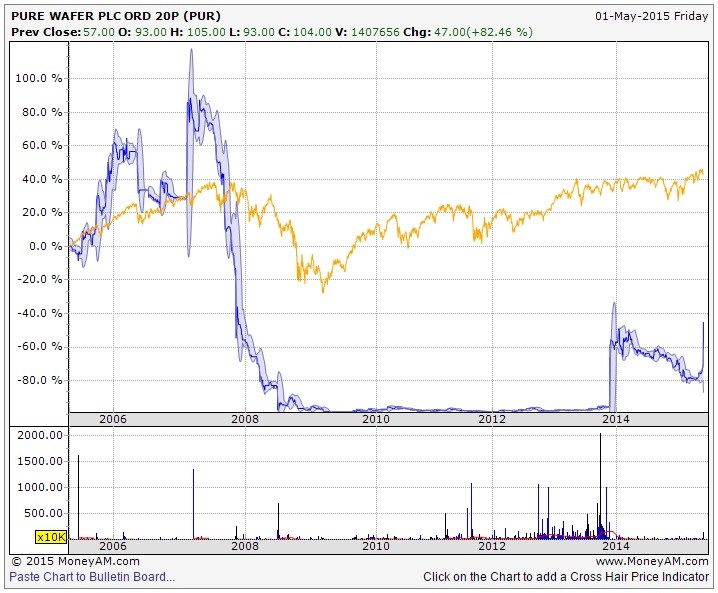

Considering that the share price closed on Thursday at 57p, but is up 84% today to 105p, the market is clearly betting on a cash return nearer the top of that range. But before we all get carried away, let's remember the underlying story here - this is a failed business and has been for years. Just look at this share price chart... pathetic really.

Analysts at WH Ireland say today that the company is left with a 'profitable wafer reclaim facility in Prescott,' but the company has delivered just one year of positive underlying earnings in five. WH Ireland speculates 100p of 'break-up value' and read between the lines of that comment, we must surely conclude a business going nowhere.

This is basically a cash shell with a modest wafer reclaim facility, one that hasn't exactly performed in the past, and may well not do so in future. Buy the shares if you want, but I'll be sticking my cash on 33/1 shot Odeon at the track tomorrow.