Small profit, large valuation; that's the likely scenarios investors face with electricals retailer AO which hopes to float on the London stockmarket in March. We expect the IPO (initial public offering) to do well as it has an attractive proposition that includes seven days a week delivery, a big push on customer service and competitive pricing. Yet that's likely to put a squeeze on margins so investors will need massive faith in the growth potential to warrant the £1 billion mooted valuation that AO is expected to get.

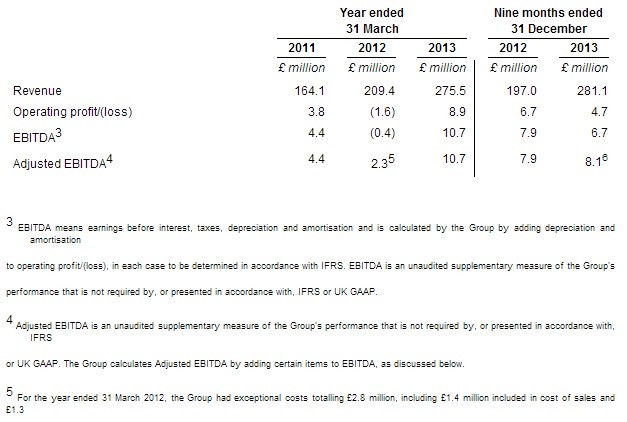

Today's intention to float announcement reveals that AO only made £10.7 million earnings before interest, tax, depreciation and amortisation (EBITDA) on sales of £275.5 million in the year to March 2013. The nine months to December 2013 had EBITDA of £6.7 million (down from £7.9 million a year earlier) on £281.1 million of sales.

AO claims to have accounted for 24% of the online major domestic application market in the UK during 2012. This is split into 19% for its own website sales and 5% for third-party branded website sales.

The business is pushing its same-day delivery model and specialist service capabilities. Current products include fridges and washing machines but AO also want to expand its range into areas like televisions.

Up to £60 million cash will be raised through the issue of new shares. Some existing investors will also offer shares for sale including directors and senior management. AO reckons it will qualify for the FTSE indices in June.

This table fleshes out the financial history. These figures will clearly leave many investors scratching their heads as to why it will command a £1 billion valuation. Ocado (OCDO) is worth three times this amount and is still loss-making, so there's obviously investor support for companies if their business proposition is attractive. Some say Ocado's potential lies with third party tie-ups.

AO could get an edge on its rivals through superior customer service. Yet electricals are a highly competitive industry with low operating margins. At the end of the day, investors will want to back a business that makes decent money. AO won't have room to disappoint on that sort of valuation.