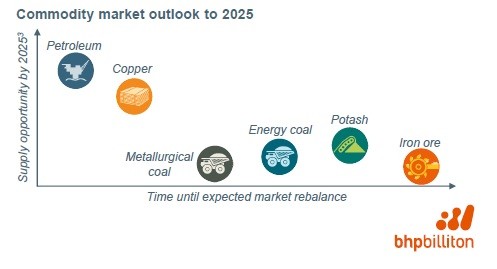

Resources firm BHP Billiton (BLT) says 'both oil and gas markets are improving more quickly than our minerals commodities' as it outlines plans for its petroleum business at an investor briefing.

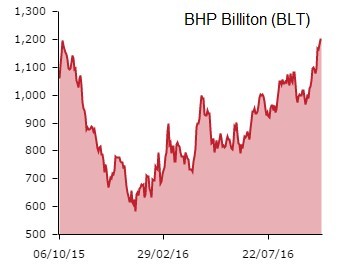

The market is unmoved with the shares broadly flat at £19.98. Highlighting a forecast increase in demand for oil and the impact of field declines and cancelled investment, president operations petroleum Steve Pastor says: 'We are well placed to capitalise on this opportunity.

'We have a large, high quality resource base. Our focus on productivity has significantly reduced both operating and capital costs, supporting a range of shale and conventional investment opportunities that would generate compelling returns at today’s prices.

'As a result, petroleum is well placed to maintain its position as BHP Billiton’s highest margin business and to grow its free cash flow contribution.'

BHP has a strong position in US shale but also a large conventional portfolio. The company says it will prioritise value over volume. The shale business generates cash at current oil prices and BHP says there is significant upside if prices recover. Its conventional portfolio includes an interest the Mad Dog field in the Gulf of Mexico where a $10 billion expansion is scheduled for approval before the end of the year.

The petroleum division already accounts for 20% of production and 30% of earnings before interest, tax, depreciation and amortisation (EBITDA). There are plans to invest in exploration and also a willingness to consider 'value accretive' acquisitions.