Data from accountancy and advisory firm BDO reveals the high street encountered a sales slowdown in September, with fashion and apparel proving the weakest category.

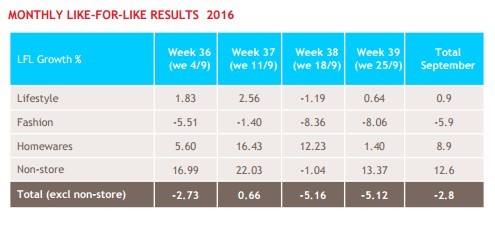

Sales declined by 2.8% during the four weeks to 30 September versus a 2.8% growth comparative a year ago, though footfall trends were encouraging overall and the homewares, lifestyle and non-store (internet and mail order) categories were in rude health.

According to the latest High Street Sales Tracker from BDO, outlining the weekly sales changes of more than 70 mid-market retailers with some 10,000 individual stores, fashion and apparel sales dropped 5.9% during a balmy September.

'Despite positive like-for-like sales growth for the homeware and lifestyle sectors, in-store sales of fashion goods performed poorly this month, dragging total sales into the negative, as warmer weather ensured discount savvy consumers continued to forgo seasonal updates of their wardrobes,' says the BDO update.

As retail guru George Mensah at Shore Capital (SGR) comments: 'Many of the incumbents have attributed the weakness in trading to warmer weather during the month - some data suggests it was one of the warmest September’s on record - which has impeded the ability to achieve strong full-price sell-through on new Autumn/Winter seasonal ranges.'

In recent weeks, tough trading conditions have been flagged by Lord Wolfson-led Next (NXT) as well as Bonmarche (BON) and their privately-owned retail rivals John Lewis and River Island.

'Looking at the non-store channel performance, September was the worst period of trading year-to-date with sales growth of 12.6%, albeit against a strong comparative of 23.9%,' adds Mensah. 'During the month we saw a ramp up in the apparel proposition of Amazon (AMZN:NDQ), Amazon Fashion, which is likely to have some of the management teams at current market incumbents twitching and sweating over their respective market share.'

As such, web-based fashion marvel ASOS' (ASC:AIM) current trading statement will be closely watched when the AIM giant posts full year results later this month (18 Oct), though Mensah believes 'the proposition in our view continues to be at the innovative end of the fast-fashion market and this remains a point of difference within its competitive strategy.'

'To conclude, the Sales Tracker confirmed the trends that have emerged from recent trading statements in the retail and wider consumer sector,' says Mensah. 'Trading has been mixed overall in what has been a challenging year for many in the sector, but beneath this there are companies that can be optimistic about not only current trading but the opportunities that are likely to emerge in the future.'

The biggest beneficiary of the Indian summer appears to have been the leisure sector, hot temperatures enticing consumers outdoors to spend their hard-earned on experiences, although surprisingly, homewares achieved an 8.9% uplift in sales with furniture, flooring and furnishings experiencing very healthy growth.

As flagged by both ScS (SCS) and DFS Furniture (DFS), the Brexit-induced slump forecast by market commentators has yet to arrive, though it is still early days following the historic vote (23 June).