The market lapped up results for the year to 30 April from defence-focussed minnow Cohort (CHRT), up 9.1% at 150p. Strong cash generation and profits, allied to a relatively bullish outlook, outweighed any concern about a slight decline in revenues.

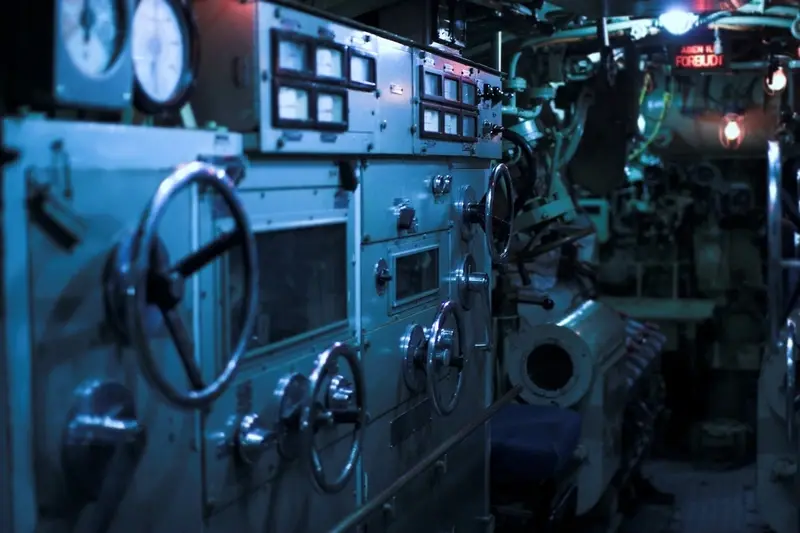

The £61.8 million cap has three divisions: MASS - specialising in electronic warfare and cyber security; SCS - providing technical support and consultancy services to the Ministry of Defence (MoD) and other bodies; and SEA - focused on sensors and communications for submarines and space flight missions.

Around 80% of its revenues come from the defence sector but crucially the group is not exposed to the indiscriminate spending cuts in the US which are likely to see almost $60 billion knocked off the Department of Defense budget in 2013. Chief executive officer Andrew Thomis explained to Shares that - although the group order book fell 10.3% year-on-year to £96 million - he sees scope for new order wins in submarine communications through SEA, export of electronic warfare products and services through MASS and air domain work through SCS.

Adjusted pre-tax profits for the year were up 15% at £7.5 million despite revenue falling 6% to £70.9 million and Thomis says the gross margin, which increased from 29.2% to 32.7%, is sustainable at a group level. The main laggard was SCS which saw significantly-reduced demand from the MoD - where Thomis conceded its technical experts were a 'soft option' for the cash-strapped government department.

Confidence in the prospects of the business as a whole was reflected in a 21% increase in the dividend to 3.5p a share. Despite returning a significant chunk of its cash to shareholders Cohort still closed the year with net cash of £16.4 million and Thomis added this may be put towards targeted mergers and acquisitions.

The cash position was 24.2% ahead of Investec's forecast and the cash generative nature of the business is reflected in the house broker's free cashflow (FCF) yield forecast of 7.6% for the April 2014 financial year rising to 10.8% in 2015. In response to the numbers analyst Andrew Gollan maintained his 'buy' rating on the stock and increased his price target from 170p to 205p.