Telco networks business Colt Telecom (COLT) will miss forecasts for consensus earnings before interest, tax, depreciation and amortisation (EBITDA) by 5% to 10% this year as pricing pressures bite into margins. The market was looking for €325 million in 2014, so investors are now faced with something in the range of €290 million to €310 million.

This might seem a small miss by some profit alert standards, yet the shares are down nearly 13% at 126.1p and they could end the day lower still. Some investors might think this a heavy-handed response. I see it the other way round, and am surprised the that the market is giving Colt such an easy ride.

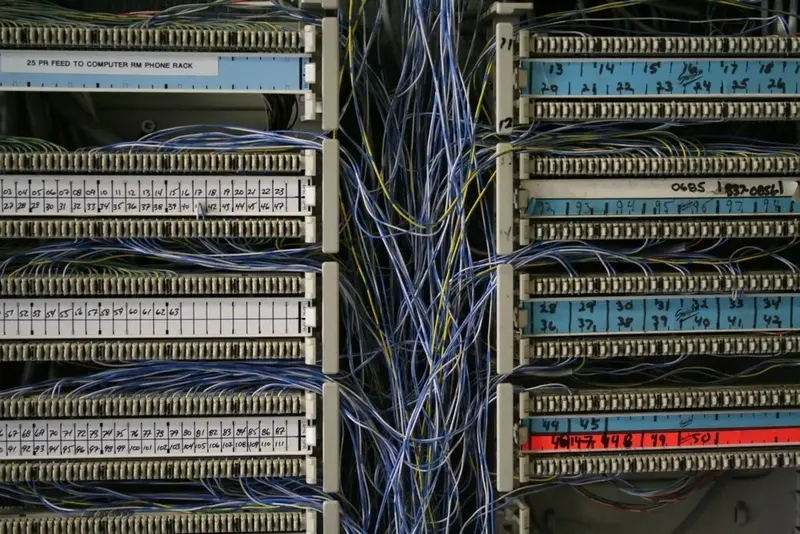

Colt has been desperately trying to switch its business model away from low-margin and declining voice services to more valuable managed data and networks for a couple of years and the transition is proving both painful and slow. Last year to December it reported €218 million of managed services revenue showing just 8% growth, less than 14% of its overall €1.57 billion of income. The truth is, Colt is legacy Leopard trying to change its spots while younger, faster new entrants eat its lunch.

This one-year chart shows how Colt's share price has underperformed the UK fixed-line telco sector.

Yet the scale of the underperformance really shows up over five years, and is particularly extreme since 2011.

Analysts at IT consultancy Megabuyte see the problem as two-fold. 'First, it seems to be forever playing catch up with younger, more nimble peers, but cannot change strategy quick enough,' says Megabuyte's Philip Carse. 'Second, it admits to suffering the loss of very high margin legacy revenues (eg SDH) as customers shift to manage network services.' SDH is Colt's legacy broadband networks business.

So Colt is now firing the gun on a strategic plan that involves ditching most of its low margin voice business, a move that will swipe about €175 million off the top line this year. Incredibly, the profits on voice are so paper thin that this move will have almost no effect on EBITDA. However, there will be jobs cuts and other costs that will total €30 million this year.

Perhaps turning down the volume on voice will pay-off, but FinnCap's Andrew Darley remains sceptical, saying that there's 'no need for investors to accept the risk with no certainty of improvement.' Darley pressed home his long-term 'sell' rating on the stock and 100p share price target.

Perhaps the best investors can hope for is that Colt gets taken over at some stage. With long-term majority investor Fidelity owning 65% of the business, such a deal could happen swiftly. But that's on the assumption a buyer can be found, and I wouldn't want to bet the farm on that.