Contact centre and secure payment solution provider Eckoh (ECK:AIM) has warned that it will miss profit expectations slamming the share price into a 27% nose dive to 35.5p. That's 35% off the record 55p hit in December 2015.

The reasons are two-fold. First, the Hemel Hempstead-based firm has experienced cost overruns in a large, complex project in a non-core division of PSS, the US secure payments business it bought in November 2015. Secondly, it is seeing a faster than expected transition towards a pure Software-as-a-Service (SaaS) pricing model in the States, where until recently, deals were predominantly on an upfront fee model.

This latter point matters for two reasons. As a capex (capital expenditure) to opex (operating expenditure) switch, the SaaS model makes longer-term profits more predictable and sticky, making them better quality. The short-term downside is that the the full annual revenue value doesn't get recognised from the get go but trickles in on a monthly basis, typically, crimping new business grow rates.

As for PSS, the contract issue is on the consulting side, a non-core bit that came with the overall PSS business. Projects work is unpredictable and, clearly, not always easy to price. It can mean bumper profit surprises, or as in today example, a nasty earnings shock.

Why would Eckoh continue with such an dicey business? The company itself can't think of enough compelling reasons so it is shutting it down asap, which was the plan any way, it's just doing it more quickly. Unfortunately, not quickly enough to avoid this particular mishap, which looks likely to costs Eckoh about £700,000 over the full year.

The combined effects of today's news sees analysts at N+1 Singer slash profit expectations fairly dramatically. 'Consequently, we cut our adjusted profit before tax forecasts in the year to 31 March 2017, 2018 and 2019 by 23%, 20% and 17%,' says Tintin Stormont.

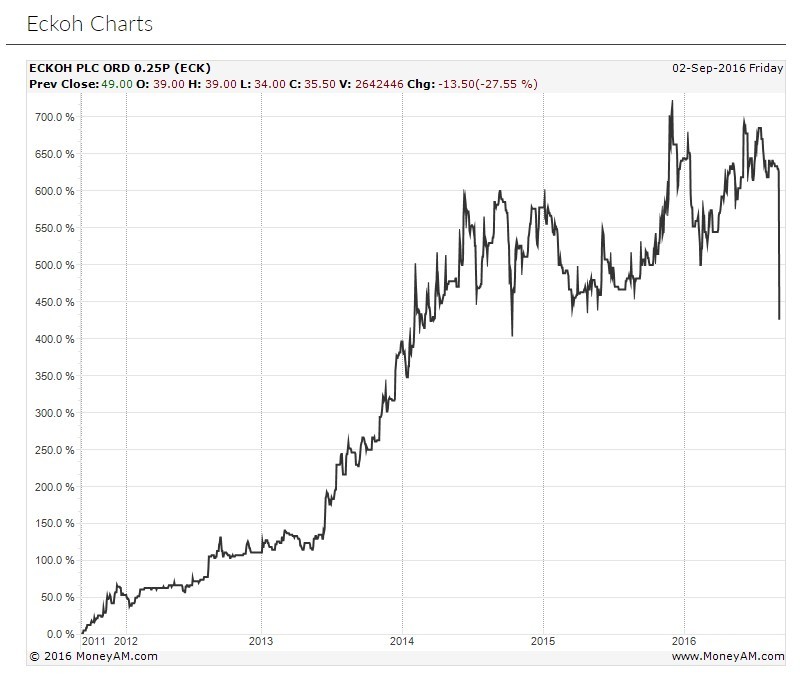

Shareholders will feel down but should really look to the brighter side. For a start, the stock has been a fantastic performer over recent years, rising steadily from 22.5p in September 2013, and from below 7p over five years. This implies that many investors will still be well in the money even after today's slump.

'The accelerated transition of the US business to recurring revenue also bodes well for the overall quality of earnings,' states the Singer number cruncher.

Megabuyte's own analyst Philip Carse completely agrees. 'Investors can take heart from the fact that the company is taking decisive action on the PSS consulting division, whilst a faster than expected transition to SaaS-based pricing in the US will bring longer term benefits.