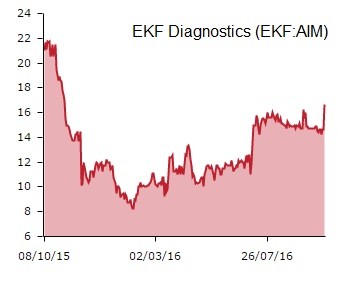

Medical testing kit manufacturer EKF Diagnostics (EKF:AIM) is up 14.8% to 16.8p as it ups its full year guidance in a bullish third quarter update.

The Cardiff-based company ran into problems when it overpaid for diagnostic services specialist Selah Genomics in 2014. Pricing in the US for the acquired business’ products were around half the $941 per unit expected. This led to a profit warning and a big slump in the share price.

After failing to find a buyer for the business, the turnaround strategy has been focused on the company's point-of-care and central lab businesses and it appears to be paying off, as Shares has previously flagged (in July and again in September).

Having already upped its guidance in a first half update, EKF says it is now running ahead of those increased expectations.

House broker N+1 Singer ups its 2016 revenue forecast by 9% to £34.7m and its EBITDA (earnings before interest, tax, depreciation and amortisation) by 29% to £4.9 million. FY16 revenue forecasts by 9% to £34.7m and EBITDA by 29% £4.9m.

Panmure Gordon reiterates its 'buy' recommendation and 17.5p price target. Analyst Julie Simmonds comments: 'A trade sale value of over 3x sales (equivalent to more than 24p a share) in 2 - 3 years is looking very achievable if the current performance continues.'