Global stock and commodity markets have had a torrid start to the year but Russ Mould, investment director at AJ Bell, takes a look at five indicators that can help investors cut through the day-to-day noise and work out whether stocks have further to fall or whether this is a chance to buy.

'Stock markets have got off to an alarming start in 2016 and it is sometimes difficult for people to assess what the headlines mean for their investments,' Mould says. 'There are a few key pieces of data that can provide investors with an indication of what might lie ahead for markets.'

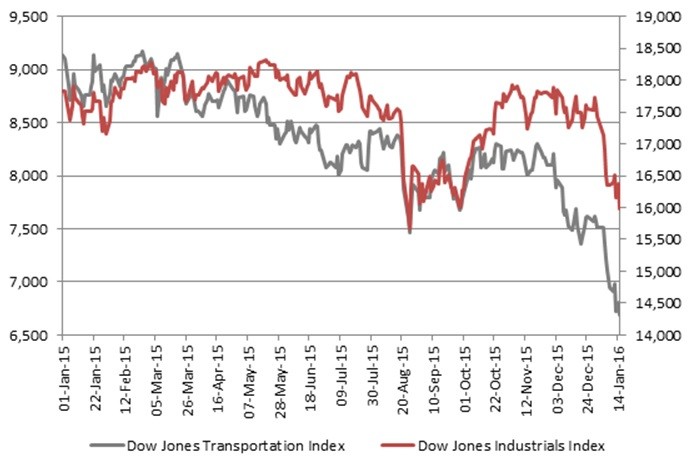

The transportation indices

The old theory goes that if the transports are not performing, the industrials can?t either, as if nothing is being shipped, nothing is being sold. The bad news is the Dow Jones Transportation index is now 27% below its December 2014 closing high - bear market territory - and still falling but any stabilisation here would be a good sign, as it could signal a turn in the Dow Jones Industrials and the US market:

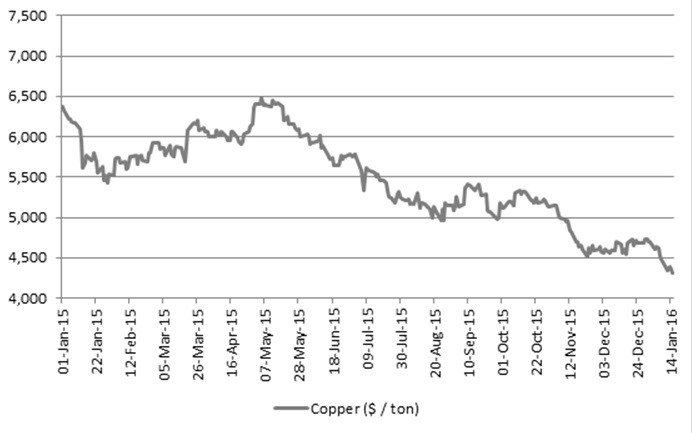

Doctor Copper

Doctor Copper

The industrial metal is a great barometer for global economic health and it currently trades at a six-year low. A sustained increase in copper prices would help ease fears that we are sliding toward a deflationary downturn:

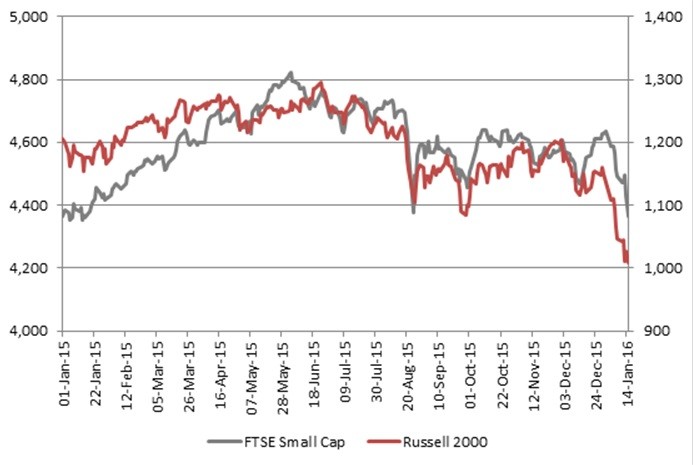

Small caps

Small caps

Market minnows are an excellent indicator of risk appetite - they tend to outperform when investors are bullish and fall faster than the broader market when they are bearish. In the UK the FTSE Small Cap is only some 10% of its highs but America?s Russell 2000 has plunged by more than 20% and is now in bear market territory, too. Bulls will want to see these benchmarks start to consistently tick higher as a sign that confidence is returning:

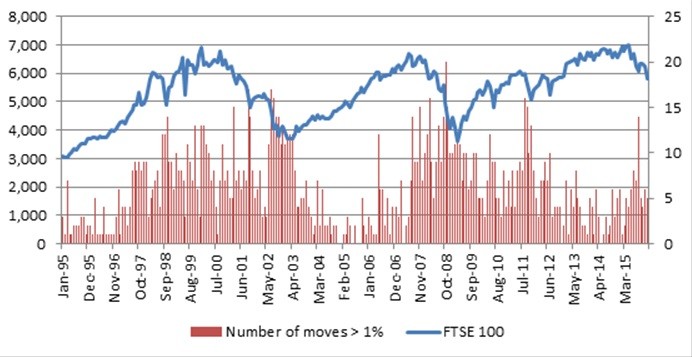

Market volatility

Market volatility

A little more conversation and little less action would be welcome. In just ten trading days the FTSE 100 has risen or fallen by more than 1% from open to close on five occasions. History shows that stock indices progress best when they make serene progress and tend to fare less well when trading is choppy and there are big swings up and down. One potential good sign would therefore be a period of calm where the market does relatively little or only moves in small steps:

Valuation - and especially the dividend yield

In the end, the valuation paid for an asset is the ultimate arbiter of the investment returns made on it. Valuation metrics using forecast earnings can be unreliable, as those forecasts are often wrong, so dividend yield can offer more comfort. Management teams are reluctant to cut the shareholder payouts as this tends to hit a share price hard. At the time of writing, the FTSE All-Share is yielding around 4%, compared to a 10-year Gilt yield of 1.7% - that?s a 230 basis point (2.3%) premium. The All-Share has only twice offered premium yield of 2% or more since 2008 (in 2009 and 2012) and on both occasions the stock market bottomed shortly afterwards: