This could be the start of something quite exciting in the social housing managed services space if Castleton Technology (CTP:AIM) can successfully sprinkle its integration/cross-selling pixie dust.

Castleton is the software and managed services buy-and-build vehicle spun-out of the old Redstone IT and telecoms business a couple of years back with the help of serial buy-and-builders MXC Capital (MXCP:AIM), a firm you can read about in-depth here.

Unlike the relative deluge of small, ambitious managed services businesses that have emerged over the past few years, largely focusing on small enterprises, Castleton targets the UK social housing and not-for-profit sectors.

A trio of acquisitions in the year to 31 March (Brixx Solutions, Impact Applications, Kypera) have transformed the scale of the operation, now the challenge is to extract the implied value of these deals through expansion and cross-selling. Yo can read the full results for yourselves here, but the integration process has clearly been a bit sticky.

'Whilst the integration of the companies that we have acquired is well progressed, the growth the company is experiencing, along with the nature of the integration activities, such as moving offices, harmonising processes and systems and getting the right structure in place, has brought some operational challenges to the group which we are actively addressing,' admits chief executive and one of the MXC founders, Ian Smith.

'Once integration is complete, we can fully focus on the numerous cross-selling opportunities that exist within the 600-plus customer base, opportunities which I am truly excited about,' he more optimistically concludes.

It's a view largely shared by Kate Hanaghan, analyst at the IT enterprise website TechMarketViews. 'Once Castleton has benefited from a full year of trading from all of its acquisitions, financial results are set to improve further,' she reckons.

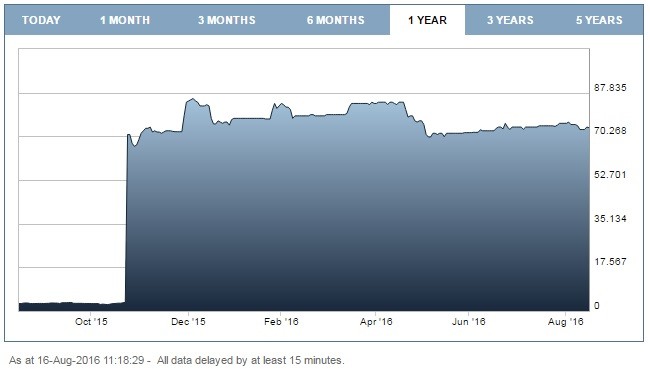

That the shares have stubbornly failed to budge at all today, or barely at all since we last looked at the stock in October 2015, is perhaps partly down to investors struggle to set a valuation for the business against a recent backcloth of such vast change.

FinnCap analyst Andrew Darley is one of the few to provide us with forecasts, his latest adjustments below.

This would imply a current year to 31 Match 2017 PE of 18.5. This may suggest that despite Smith's vast experience and long list of successes in the IT buy-and-build space, the company and its share price may need a bit more time to grow into its valuation.