Iconic luxury shoe specialist Jimmy Choo's (CHOO) growth slowed in the six months to June, hit by a 'backdrop of uncertain and challenging markets'. In a mixed outlook statement, CEO Pierre Denis also cautions 'the impact of changes to tourism is expected to continue to affect our retail business' in the second half, causing the shares to stumble 2.3% lower to 162.8p.

Jimmy Choo is one of a number of luxury stocks hit by fears over Chinese spending and today's interims have hardly helped sentiment. At constant currency, total sales growth slowed from 12.2% for the full year to December to 6.5% in the half.

Disappointing retail like-for-like sales growth of 3.3% reflected tougher conditions in the luxury industry, impacted by China's economic cooling and disruption in Hong Kong. Earnings were also hit by 'the temporary closure of a number of stores for renovation in the first half, especially Sloane Street', the timing of new store openings and the Russian rouble crisis.

Amita Gulati, analyst at Edison Investment Research, points out that 'some of the major luxury goods players have recently beaten forecasts with weaknesses particularly in Hong Kong and Macau more than offset by strong performances in other parts of the world and these figures are likely to be below expectations.' Gulati also notes 'the company expects the impact of changes to tourism to continue having an effect on the retail business in H2 and given the slow-down in sales, flat adjusted EBITDA (+0.4%) and 3% growth in adjusted net income in H1, consensus forecasts are likely to come down.'

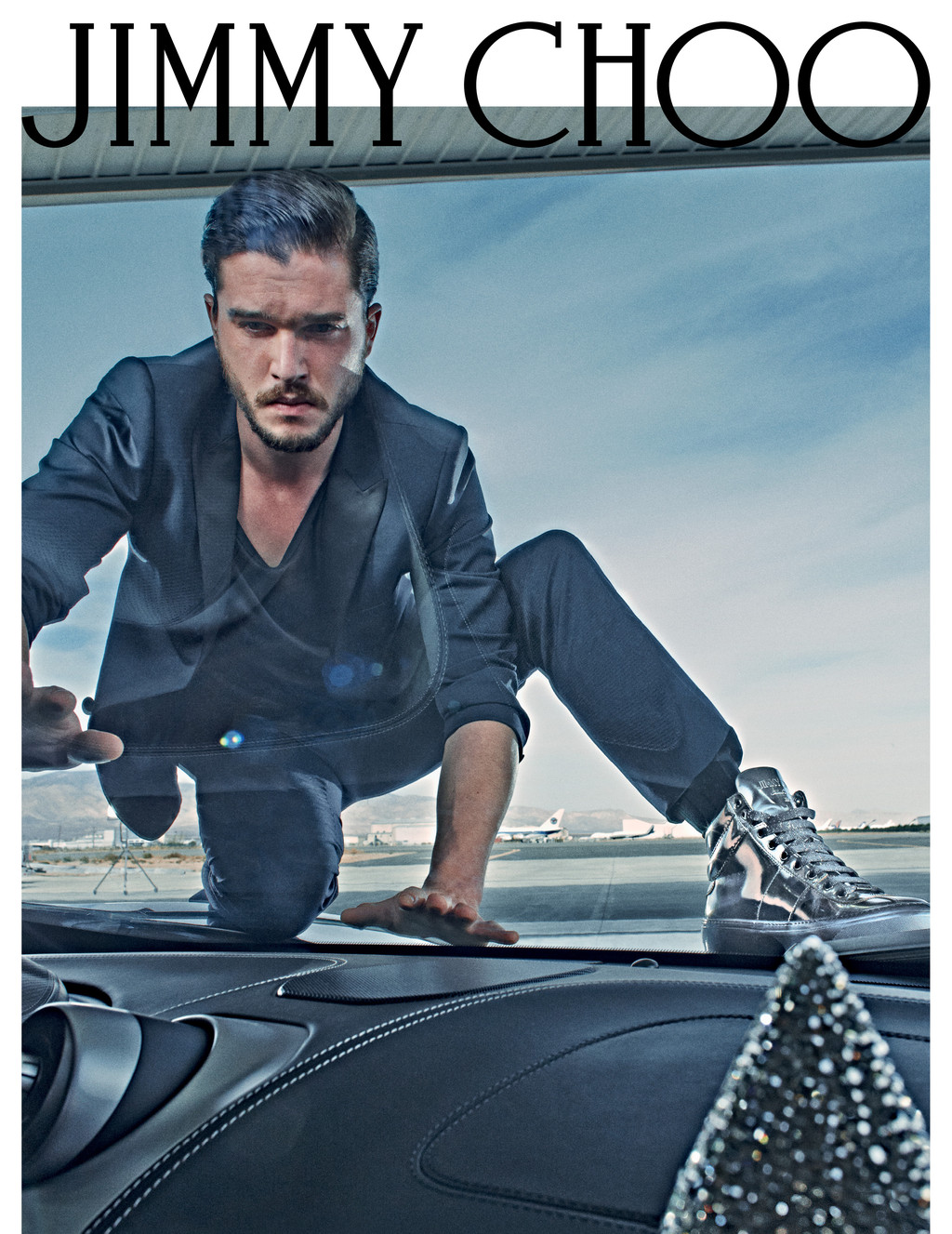

The good news is Jimmy Choo remains in growth mode, flagging 'particular success with the Cinderella shoe and capsule collections' and rapid expansion in men's shoes. A cameo appearance in the opening section of the Oscars provided an additional boost for the brand, co-founded in 1996 by Tamara Mellon and its eponymous couture shoemaker, popularised by television series Sex and the City and floated on the Main Market last year (17 Oct '14).

In a note entitled 'Bull in a China shop', Liberum Capital, a buyer with a 210p price target, says 'Choo has no plans to slow its Chinese store rollout' and even points out 'currency devaluation could drive more Chinese to shop at home so sales may even accelerate'.