Tanzania-focused Kibo Mining (KIBO:AIM) has scrapped a plan to merge its gold assets with Lake Victoria Gold in favour of new deal with cash shell Opera Investment (OPRA).

Opera will effectively conduct a reverse takeover of the gold projects and rename itself Katoro Gold.

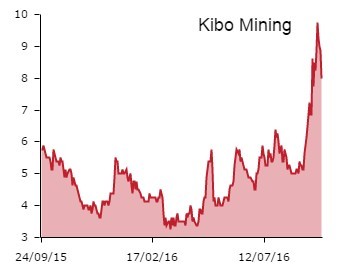

The fact that Kibo’s shares have fallen 9.8% to 8p is down to a separate announcement concerning delays to receiving money from a Chinese contractor.

SEPCO III hopes to become the engineering, procurement and construction partner on Kibo’s coal to power project, also in Tanzania.

Kibo said in August that SEPCO III would pay for some of the associated development costs by 22 September. That deadline has now been pushed back to 14 October, which has clearly disappointed some investors.

The demerger of the gold assets is in line with Kibo’s strategy to become a pure-play power business and not a diversified miner.

Opera floated on London’s Main Market in April 2015 with a view to buying a company in the natural resources industry.

It has been a bumpy ride so far. It originally tried to buy SoloPower Systems, a US-based solar materials manufacturer. A year later, SoloPower’s parent company Hudson Clean Energy Partners said the deal was off.

In summer 2016, Opera had a look at Highlands Natural Resources’ subsidiary Highland Helium Development but decided not to buy it.

Opera’s future now lies in gold, assuming it can raise at least £1.2 million to support the Kibo acquisition. It has proposed to raise the cash at 6p per share and switch its listing from London’s Main Market to AIM.

It hopes to publish an admission document by the end of November 2016, which would suggest the shares may start trading on AIM in December this year or January 2017 assuming all goes to plan.