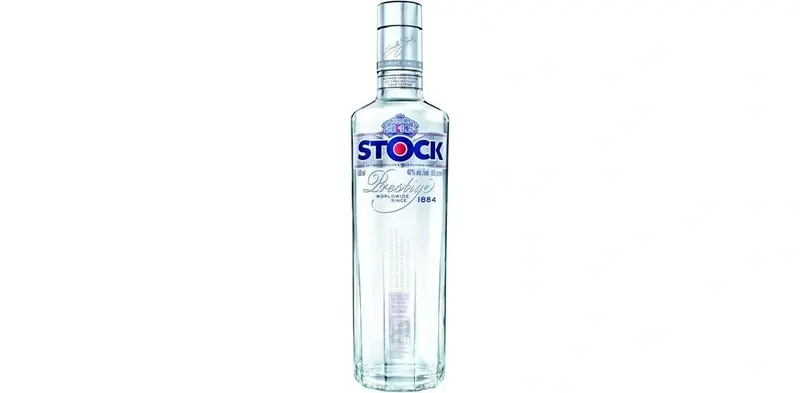

On a quiet day for corporate news, with weak miners offsetting strength in banks, investors raise a glass to Stock Spirits' (STCK) admission to trading on the London Stock Exchange's (LSE) main market. Frothing up 4p to 232p early on, the branded spirits producer boasts the largest market share for spirits in Poland and the Czech Republic. Guided by chief executive Christopher Heath, the ambitious company's vodka brands Czysta de Luxe, Zoladkowa Gorzka and Stock Prestige as well as vodka-based flavoured liqueur Lubelska.

WPP (WPP) ticks up another 0.7% to £13.35 as Investec highlights the ?buy? case for the global media agency which yesterday reported an acceleration in third-quarter like-for-like revenue growth, now running at 5%.

Sports marketing specialist Chime Communications (CHW) slips 1.6% to 318p on news of a discounted placing to fund the acquisition of JMI, a global marketing firm focussed on motorsports, operating primarily in Formula 1.

Specialty chemicals group Elementis (ELM) jumps 4.8% to 256.1p after the £1.1 billion cap says sales grew 12% over the third quarter to 30 September despite a challenging market backdrop. A return to more normal trading patterns in the oilfield drilling industry and the successful integration of two recent acquisitions, Watercryl in Brazil and Hi-Mar in the US, are among the quarterly highlights.

Life assurance and pension fund consolidator Phoenix Group (PHNX) improves 3.3% to 801p as the running Shares Play of the Week pleases with news of year-to-date cash generation of £734 million. With £434 million generated in the nine months to end-September and a further £300 million during October, the £1.74 billion cap is on course to achieve the higher end of its £650 million-to-£750 million annual cash generation target.

Gas mask and dairy products maker Avon Rubber (AVON:AIM) gains 1% to 548p as it announces two contract wins associated with its diving equipment VR Technology business - acquired for £3 million in May. No value for the contracts has been given.

Record third quarter profits from Samsung Electronics (005930:KS) are seen as an encouraging sign for semiconductors developer Imaginations Technologies (IMG). The South Korean electronics giant is one of Imagination's biggest customers, so investors are happy to bid the shares 3.5% higher to 291.1p.

A contract with Channel 5 sparks an 8% jump to 33.5p for cloud-based broadcast editing suite supplier Forbidden Technologies (FBT:AIM). Investors are clearly hoping the deal is scalable in future. Read our thoughts on the announcement here.

Victoria Oil & Gas (VOG:AIM) ticks up 0.4% to 1.15p despite reporting a widened pre-tax loss of $15.9 million for the 12 months to the end of May. The company, which has halved in value in the last year, was hit by the costs of moving from the exploration phase into production from its assets in Cameroon.

North Sea oil firm Antrim Energy (AEY:AIM) surges 24% to 7.75p as it announces the resumption of output from its Causeway and Cormorant East fields. Production has been suspended since September (10 Sep) to allow for maintenance - the group also confirms output from Causeway is expected to rise over the next year with the startup of the electrical submersible pumps and commencement of water injection operations.

Medical device company Sphere Medical (SPHR:AIM) rises 1.6% to 31.5p as its Proxima system, a blood gas analyser, moves closer to securing its CE Mark authorisation.

Penny share Blavod Wines & Spirits (BES:AIM) perks up 11.1% to 1.25p on news it will be promoting its RedLeg Spiced Rum brand with so-called 'pop-up Rum Shacks' across the UK's major cities. Earlier this week, the £3.4 million cap announced it has raised £571,300 at 1p a share for investment in owned brands including RedLeg and the recently relaunched Blackwoods gin.