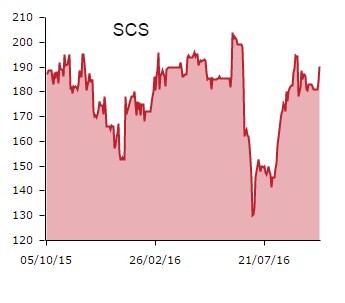

Cash-generative sofas and carpets seller ScS' (SCS) stellar full year results receive the thumbs up from investors on Tuesday, helping the shares 3.3% higher to 190p as their rebound since the Brexit vote continues.

Encouragingly, CEO David Knight (pictured below) reports 'significant growth across all areas of the group' for the year to July, like-for-like orders leaping 14.8% to record levels.

Click here to unpack preliminary results from the 'Sofa Carpet Specialist', already gearing up for the festive season with an 'IT'S A YES FROM SCS!' advertising splurge. The numbers reveal a swing into the black at the pre-tax level that reflects continued market share gains as well as lower finance costs and the absence of IPO-related exceptionals.

Supported by a ramp-up in marketing spend, Knight says the results 'demonstrate that the group has made significant progress in developing ScS into a strong national brand with three very clear retail offers - upholstered furniture, flooring and our House of Fraser concessions, all supported by an online platform that has seen continued investment.'

Marketing spend increased from £19.2m to £23.1m last year as ScS invested in brand awareness and increasing its footfall and website hits. ScS' arrangement with House of Fraser - it operates the furniture and carpet concession ranges in 28 House of Fraser department stores, thereby targeting more affluent shoppers - also grew sales 19.7% to £25.3m and turned a maiden profit.

Being a purveyor of high ticket items in an uncertain world following the vote to depart the EU, the market is reassured by ScS' current trading statement, confirming sales from stores open for at least a year remain in positive territory. The fabric and leather sofas specialist reports 4.5% growth in same-store sales for the opening 9 weeks of the new financial year, good going given last year's demanding 13.3% growth comparative.

Trading from 97 stores, almost all in out of town retail parks, the ScS range is designed to appeal to a broad customer base through a mid-market priced offering. Stressing it purchases all products in sterling, ScS remains in expansion mode and with £22.4m of cash and no debt, has the balance sheet to support its future growth ambitions and fund a progressive dividend, the full year payout upped 3.6% to 14.5p.