It's a hot area, everyone seems to be talking cyber security at the moment, which doesn't surprise us at at Shares one bit. We've been flagging this as a core, long-run hotspot for ages and recently published an extensive cover feature on the topic just days after the recent TalkTalk (TALK) hacking attack. So today's news that Manchester-based NCC (NCC) is further bolstering its own anti-hacking arm look swell-timed and in the right strategic place.

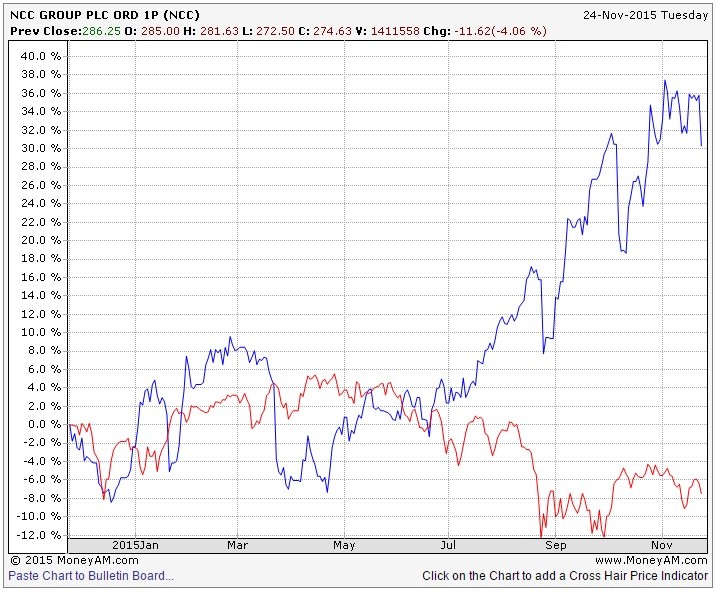

Security consulting and software escrow business NCC has announced the strategically significant acquisition of Fox-IT for ?133 million, or roughly £93.5 million. That's about 15% of NCC's own £630 million market value, based on today's 275.25p share price, off about 3.8%.

The stock's off because the company is raising £126 million via a share placing at 275p, albeit at a very modest sub-4% discount. Based in the Netherlands, Fox-IT provides cyber security consulting solutions and managed services. It posted profits of ?3.2 million on revenues of ?24 million in the year to 31 December 2014.

This follows the acquisition of managed security services provider Accumuli in March, which increased NCC?s security footprint and created a fourth arm to the NCC business.

This is a 'substantial acquisition and fundraising that expands NCC?s customer base internationally and broadens its product set,' points out David Johnson, tech analyst at broker Northland.

But what about the price? At ?133 million NCC is paying a trailing PE multiple of over 50-times, although this will clearly come down significantly on a current year basis given the growth trajectory of Fox-IT. Northland reckons the profit multiple of the acquisition comes in at around 41.6-times pre-tax profit versus NCC?s 27.7-times multiple.

Megabuyte's Ian Spence seems to nail the issue. 'On first inspection we have rather mixed feelings about this move by NCC; while it makes perfect strategic sense, even if profits have grown rapidly in 2015, NCC is paying a very high price for what is still essentially a people business,' the analyst says.

N+1 Singer's Oliver Knott tends to agree. 'A 5.4-times historic revenue multiple looks expensive and the acquisition will not be earnings enhancing in its own right until full year to May 2018.' But the analyst also makes another interesting point, that NCC is one of just a handful of ways to play the key cyber security theme via UK-listed shares. So perhaps the strategic value will ultimately justify the apparent hefty cost. Time will tell.