Investors are more than pleased by half-year results from FTSE 100 house builder Persimmon’s (PSN), which showed a 29% hike in pre-tax profit but also spun a confident outlook line into the future.

The group's pre-tax profit increased from £272.8 million to £352.3 million, year-on-year, for the six months to 30 June. Revenue rose 12% to £1.49 billion, while legal completions rose 6% to 7,238 new homes sold.

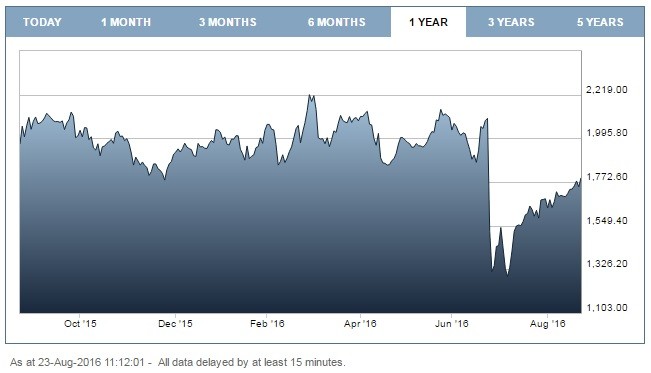

But it is the evident optimism of chief executive Jeff Fairburn towards the future that has really given a lift to investor sentiment today (read here), sending the share price around 4.7% higher to £18.78.

'While the result of the EU referendum has created increased economic uncertainty, customer interest since then has been robust with visitor numbers to our sites around 20% ahead year-on-year,’ he explains.

Persimmon notes that its private sale reservation rate since 1 July is currently 17% higher compared to the same period last year, and while the group is now in its traditionally quieter, slower summer weeks, 'customer demand remains encouraging and we anticipate a good autumn sales season,' confidently predicts Fairburn.

Despite expected falls in house prices, Persimmon reported a 6% increase in the average selling price to £205,762.

Analysts at Davy Research remains reasonably optimistic following an increase in purchase cancellations directly after the Brexit result while believing that the business is well-placed to take advantage of future opportunities with a £462 million net cash war chest.

But Davy does caution on Persimmon's land-buying due to the ongoing economic uncertainty that surrounds both the industry and the UK itself.