That Rolls-Royce’s (RR.) shares can rise 15% on falling sales, profit and a dividend cut shows just how bearish investors had become on the aerospace and marine engineer’s prospects.

Leading the market higher this morning, investors were cheered by management’s commitment to previous guidance on profitability in 2016 and progress on cost-cutting initiatives.

Rolls’ order book, which grew 4%, was another reason for optimism.

Chief executive Warren East says that while 2015 was a year of change at Rolls-Royce there were some important constants which could underpin a longer term recovery in the firm’s performance.

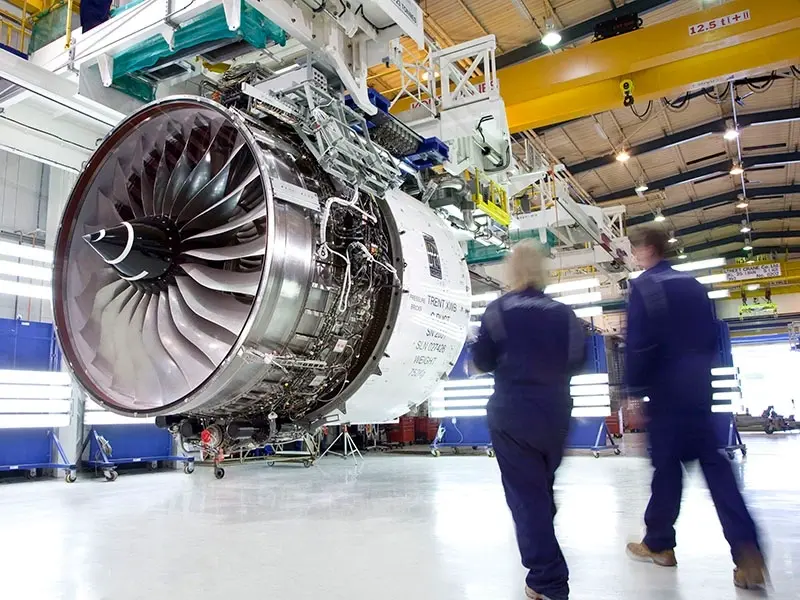

End-markets grew, East says, and ‘the quality of our mission critical technology and services, and the strength of customer demand for these’ are reflected in the growing order book.

The UK-headquartered manufacturer is aiming for a 50% global market share in wide-body passenger aircraft engines over the next 10 years, East adds.

Analysts at Investec are not so sure, saying a series of one-offs boosted results for the year to 31 December 2015.

‘Whilst the initial pages of the statement read positively, there are a series of concerning details in the increased divisional disclosures, including lower second half order intake in Power Systems and guidance for increased costs at Defence and Nuclear,’ writes analyst Rami Myerson.

‘Our view remains that the premium valuation does not reflect a series of medium and long term challenges to profits and cash.’

Rolls-Royce has five core units: Civil Aerospace, Defence, Power Systems, Marine and Nuclear.

Shares trade 15% higher at 611p.