Royal Bank of Scotland’s (RBS) six year battle to sell 315 of its branches is set to continue after Santander pulled out of talks.

This is the second time that discussions with the Spanish lender have broken down. A failure to agree price for the branches, branded as Williams & Glyn, is reported to be behind the talks collapsing.

The uncertainty surrounding the terms of the UK’s divorce from the European Union and what it could mean for the economy may have been a factor in disagreements over price.

The European regulator has told RBS to spin-out the branches under the terms of its state bailout in 2008.

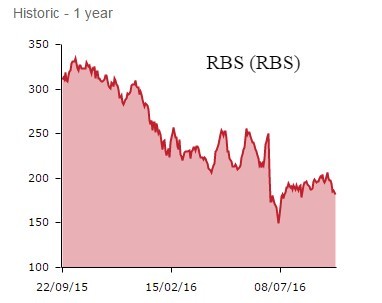

Shares falling 0.9% to 182.5p shows that the market is not too concerned by this setback, but management will be under more pressure to sell those branches with the end of 2017 deadline approaching.

This could mean that it will have to accept less than the £1.9 billion it is believed to want for the business that is home to 1.7 million retail customers. Adding in the £1.5 billion it has spent trying to sell the business makes it appear that RBS could make a loss on the sale.

Eight years after the tax-payer injected £45 billion into RBS to stop it from collapsing, A return to profit or indeed to private ownership appears years away.

Management has other issues to deal with too. RBS is one of several lenders to be swept up in the mis-selling of mortgage securities in the US. Billions of dollars in fines are expected.

Deutsche Bank has already been told to pay the US regular $14 billion for its role in the scandal.

It appears that for RBS there could be more bad news to come.