A narrow victory last night sees Sirius Minerals (SXX:AIM) finally get permissionto build a very large potash mine in Yorskhire. The North York Moors Park Authority voted 8-7 in favour of the mine, meaning Sirius has now cleared the biggest permitting hurdle. The next job is to get £1.4 billion to build the first phase of the mine.

Investors are ecstatic about the result, bidding up the share price by 89.2% to 28.38p. Analysts are now reworking their models to factor in permitting success. Liberum says it will factor in a new polyhalite pricing methodology into its valuation. At present it believes Sirius will predominantly finance mine construction via debt. It believes an equity component could be raised at 35p per share.

Polyhalite is the premium-priced potash material contained in Sirius' York Potash project which is approximately 4 kilometres from Whitby in North Yorkshire. The company will transport the polyhalite material via an underground conveyor system to a port for processing and export.

Chief executive officer Chris Fraser (pictured) recently told Shares that he expected a definitive feasibility study to be published later this year and that the major financing would happen in Q4, 2015 or Q1, 2016. Sirius is looking for a strategic partner to help with financing; a potash distributor is the preferred choice.

'Based on pre-feasibility cost estimates and management’s initial target pricing of $150/t, the project has the potential to deliver EBITDA margins of up to 78% (and IRR >20%),' says Liberum. 'In combination with the potential for endorsement from infrastructure UK, which would drastically reduce the risk of debt holders, Sirius looks well positioned to deliver a debt solution which maximises equity returns.'

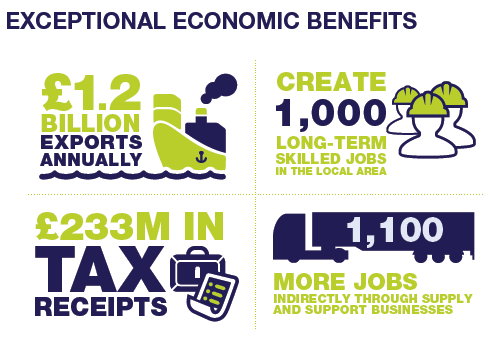

WH Ireland analyst Paul Smith calls the planning permission green light 'great news for Sirius Minerals and its shareholders and also for the local economy'. He adds: 'There will obviously be conditions attached to the permitting and quite rightly the NYMNPA will keep a close eye on the development of the project, particularly during construction. However, we feel that the project is sympathetic to the environment and its footprint will be small in the national park especially given the size and scale of the project.'

Shares has long championed the potential for Sirius Minerals to create value for shareholders, having highlighted its appeal as low as 2.25p in August 2010 when it was focused on assets in the US and Australia. We last wrote on the stock in the 21 May issue of Shares, with a bullish view at 19.25p in the belief it would get planning permission.