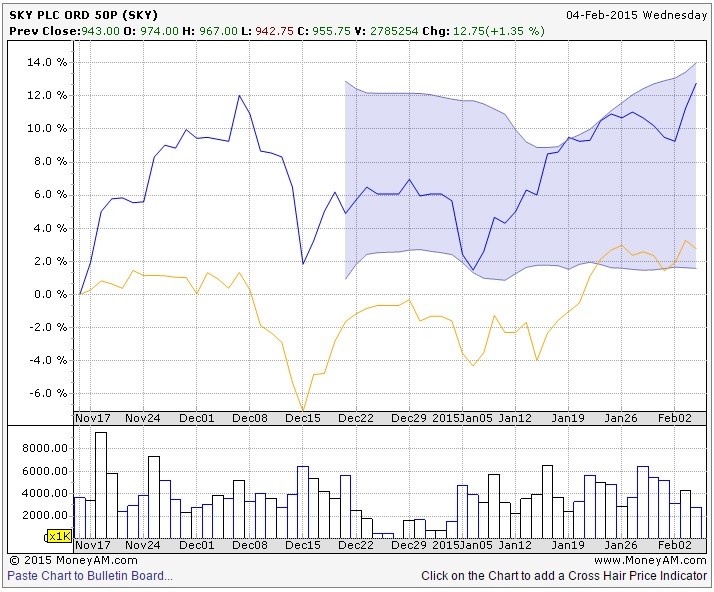

Pay-TV giant Sky (SKY) beats expectations with its interims and, perhaps most significantly, posts its strongest UK growth in nine years. The shares rise 1.6% to 957.8p today but had already performed strongly leading into these results which cover the six months to 31 December.

The addition of 204,000 new UK and Ireland customers in the period - the most since 2005 - is a good response to naysayers, ourselves included, who argue the group has reached saturation point in its domestic business.

In its first results including the newly acquired Italian and German businesses Sky's adjusted operating profits for the half year were up 16% to £675 million. That was ahead of consensus at around £644 million. The German and Austrian business experiences its highest ever user growth with 214,000 new customers, while Italy shows 'resilience with good customer growth in a challenging economic environment,' according to the company.

In other recent developments the group announced Tuesday (3 Feb) it had secured exclusive rights to show the Open golf championship live from 2017 - further boosting its content - and outlined a move into the mobile market through a multi-year agreement (29 Jan) to offer services through the 02 network from 2016. This means Sky will have a so-called quad play offering (TV, broadband, landline and mobile).

Its not all good news - as expected the expansion into Europe has resulted in a drastically more leveraged balance sheet with net debt increasing from £1.43 billion to £6.27 billion.

Westhouse Securities maintains its neutral recommendation and 930p price target and says it views 'the group’s current valuation as up with events given Premiership rights uncertainty and eurozone exposure'.