Everyone's looking for income stocks these days. Companies are bending over backwards to pay dividends as they realise it can attract a broader range of investors. But can they afford to pay this shareholder reward?

With this thought in mind, we've run the numbers on the market and discovered that 260 small cap stocks are forecast to pay dividends at the end of their current financial year. That's quite an impressive number, but also reason to remind investors of the questions you should ask of any company expected to pay a dividend.

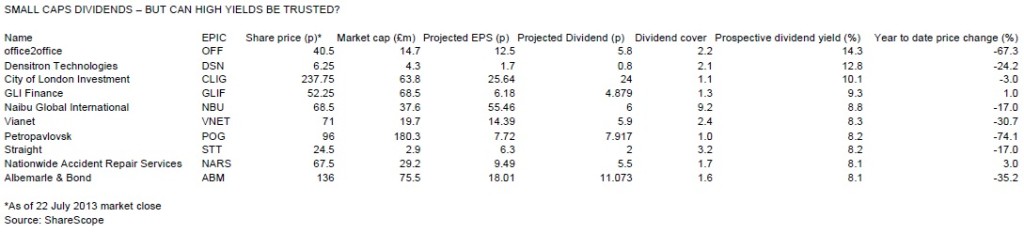

Are earnings per share expected to be greater than the dividend paid out? We like a dividend cover of 2 times or more. Steer clear of any small cap with a dividend cover less than 1.5.Look at earnings strength - if trading is poor, this raises the chance that there's not enough cash being generated to pay expected levels of dividend. Don't forget it is CASH that pays the dividend.A prospective dividend yield above 8% is rarely sustainable unless there's significant levels of cash generation and the money isn't needed elsewhere. (Even then - check to see if the company is reinvesting cash to sustain and grow its business. It if isn't, then why not?)We've classified small caps as being companies valued at £200 million or less. Using software from ShareScope, we've looked at forecast earnings per share, dividend and latest share price, providing the figures so we can calculate the anticipated yield and dividend cover. We've ignored a few stocks where there's simply going to be a one-off return of cash like PV Crystalox (PVCS), Local Shopping REIT (LSE:AIM) and TVC (TVCH:AIM).

Click on the following table to enlarge and see the top 10 small caps by prospective dividend yield.

Ordering the stocks by highest prospective yield immediately throws up some interesting names where the dividend payout looks very unlikely. Office2Office (OFF) is fresh from a profit warning and has fallen by 67% to 40.5p since the start of the year. We flagged the big risks hanging over this business in a 'sell' call at 93.75 in April. Although expected earnings are more than twice the anticipated dividend payout, this is a classic example of a stock not to buy simply on the basis of its high yield - presenting 14.3%.

The market is effectively saying it doesn't believe Office2Office shareholders will get the forecast dividend, otherwise the share price would be much stronger. The same applies to Densitron Technologies (DSN:AIM), trading on a prospective 12.8% yield. A quick glance at its last set of results (published in May) shows that the dividend was slashed in half as profits declined. A trading update in June suggests that life has not improved for the company, so we fail to believe it will pay 0.8p per share dividend at the end of 2013, as per market forecasts.

More interesting is Naibu Global International (NBU:AIM) which offers an 8.8% prospective yield. The expected 6p per share payout is covered 9.2 times by forecast earnings per share. The Chinese manufacturer and supplier of branded sportswear issued a decent trading update last week. Yet the share price has more than halved since joining Aim in April 2012, so again a stock where the market doesn't believe the numbers or valuation. There's certainly a distrust among UK investors towards Chinese companies, yet we'd point to directors buying shares in July as a positive signal. Read our recent analysis of the stock here.