Everyone could see the squeeze on engineer's margins coming. But the extent of the pressure now being felt by the industry is taking most by surprise.

Just about every major engineer that reported results over the last few weeks fell heavily and all are down over the last month: IMI (IMI), Weir (WEI) and Bodycote (BOY) have all underperformed the FTSE All-Share, some significantly so.

Only Melrose Industries (MRO) has bucked the trend - and that because it sold almost all of its business to US outfit Honeywell (HON:NYSE).

Even bullet-proof Spirax-Sarco is feeling the heat of a global slowdown in industrial activity. Shares in the Cheltenham-headquartered engineer, regarded as one of the highest quality firms in the sector, are down 6.3% to £31.75 today.

Only in April the stock was trading at an all-time high, above £36, when it announced plans for a 120p a share special dividend. After accounting for the special dividend, shares are down around 10% since then.

Spirax's update for the six months to 30 June tells a similar story to those of its peers. Industrial production, which tends to be a lead indicator of engineering operational performance, grew just 1% in the last 12 months, according to Spirax's estimates.

Slower growth in emerging markets, notably China, Russia and South America mean global industrial production is teetering on the brink of contraction.

Even for diversified Spirax, this is bad news. China represents 10% of its total sales.

Operating margin slipped 0.4% points to 20.6% and sales grew 3% on an organic, constant currency basis. At actual currencies, sales were flat.

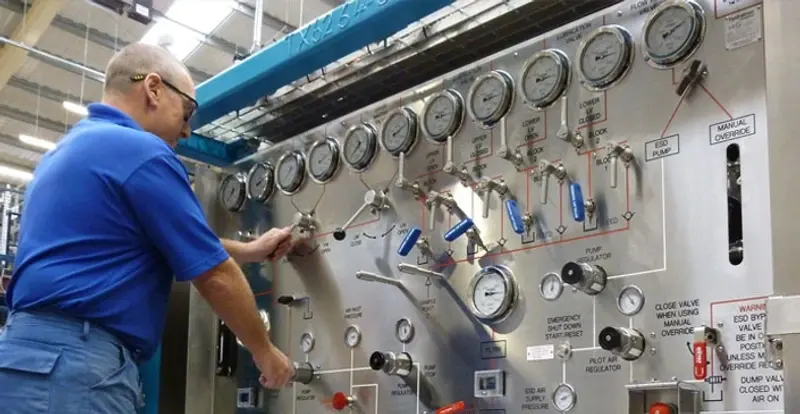

But the £2.3 billion engineer still has an ace up its sleeve. It's Watson Marlow unit, which provides specialist pumps, hoses and valves, is growing at a 13% clip in both revenue and operating profit.

Watson Marlow sales were higher in most industry sectors, including its largest customer the biopharmaceutical industry. At £21.8 million, the unit contributed 32.5% of operating profit, up from 29.8% a year earlier.

Niche specialisms and innovation look like they will become an increasingly important weapon for engineers as they contend with stalling end-markets.

Those which are able to invest in and deliver on these initiatives should be able to weather whatever economic storms come their way.