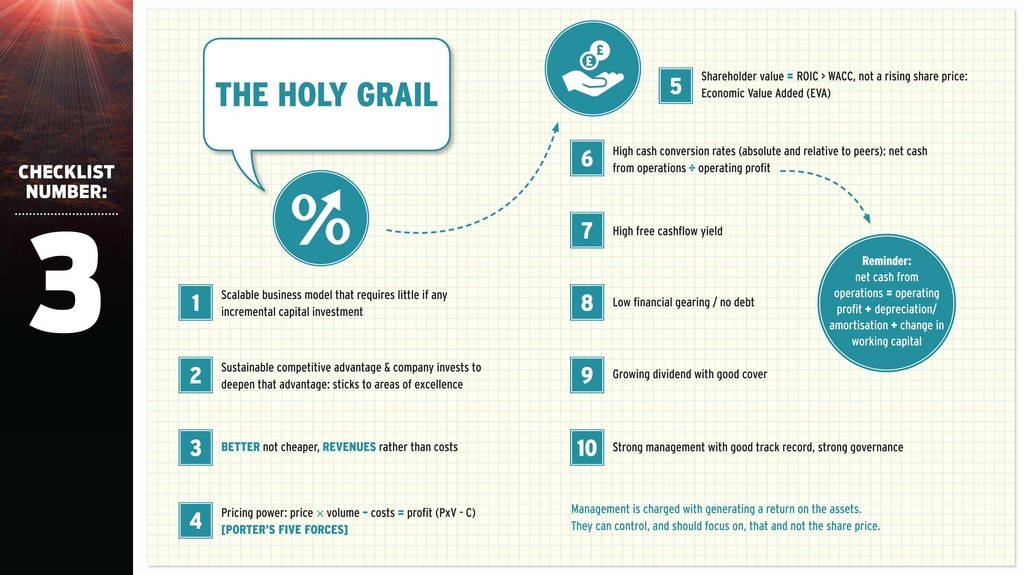

The search for the ideal investment opportunity might not perhaps have the glamour of an Arthurian quest but it remains nevertheless a holy grail for most investors.

Shares? own quest for the portfolio equivalent of a priceless artefact, a checklist that targets picks which generate premium total shareholder returns (TSR) on a consistent basis, begins with the notion of a truly scalable business.

(Click on following image to enlarge)

A scalable business is one that can easily and efficiently be enlarged without requiring major outlays in time or money. In practice this means a firm can design a product or service once, use it often and sell it many times.

The increase in sales through a relatively fixed cost base and minimal additional capital investment mean the company can generate the fat profit margins and healthy free cashflow which in turn fund both further growth and also juicy dividend payments to shareholders.

Software companies fall in this category because selling more products, usually in the form of licences, does not necessitate much more expense. Online businesses often have potential for scalability as they offer services that traditionally were offered in physical form via branches or shops and required expenditure on rent, rates, utility bills and staff salaries; broking, banking and e-commerce are good examples.

A business like Amazon (AMZN:NDQ) at its inception bore many of the hallmarks of a scalable online business and that was why investors bid its stock to the moon at the end of the twentieth century. The business seemed to tick the growth boxes very favourably compared to traditional high-street retailers. While the bricks-and-mortar bookseller needed to carry a substantial amount of inventory, the online retailer could get by with only a couple of days? worth of stock at any given time. But - rather like the Grail itself - this impression of scalability turned out to be somewhat illusory in that Amazon?s capital expenditure on its retail architecture proved prodigious, both in the form of warehouses and working capital. This realisation pummelled the stock as the tech bubble burst and Amazon suffered a vicious de-rating even if the growth subsequently generated has reinvigorated the share price.

Keep an edge

Another trait of an ideal company is the development of a competitive advantage which careful capital investment, in the form of capex and research and development, then maintains and even deepens. ARM (ARM) is often held out as a good example of a business that has found the sweet spot between competitive advantage and scalability.

The Cambridge-based concern is the world?s leading exponent of the semiconductor intellectual property (Semi IP) model. ARM does not make silicon chips. It does not even design them. It develops architectures for microprocessors which other firms then license and use as a basis for their own designs. ARM gets paid for the licence, many times over as rival chip firms buy the IP, and also receives a royalty every time a product that a features chip based on its architectures is sold. The customers benefit since they save time and money and get their gadgets to market more quickly. They tend to be sticky and the UK firm difficult to dislodge. These benefits underpin ARM?s extraordinary track record of profit and cashflow growth, numbers which in turn explain why the market is prepared to pay a price/earnings ratio of 47.9 times consensus 2013 earnings and 38.3 times for 2014 to own it.

Better not cheaper

Another quality to look out for in that ?perfect? stock is a strategy that places greater emphasis on quality than competitive price or put another way, a business that believes in better not cheaper. This leads onto the concept of pricing power. Companies that have a competitive edge are able to set prices rather than take them, control their own destinies and ultimately generate higher returns for their shareholders.

This capability comes from a strong competitive position and is perhaps best explained with reference to the key competitive forces identified by Harvard Business School professor Michael Porter. These are set out in his seminal 1979 paper How Competitive Forces Shape Strategy, first published in the Harvard Business Review, and a follow-up piece of research released in the same august journal in 2008. The five forces are

? competition within an industry

? the threat of new entrants

? the threat of technological change

? the bargaining power of buyers

? the bargaining power of suppliers

British Sky Broadcasting (BSY) is a company that we believe scores highly in a Porter analysis on pricing power. Sky has seen off competition from the likes of ITV Digital, Setanta and ESPN to remain the dominant force in UK pay-TV market. There are competitors in various content niches such as BT?s (BT.A) foray into Premiership football and Netflix (NFLX:NDQ) in the TV-on-demand segment but few rivals will have the economies of scale at their disposal that are boasted by the Murdoch behemoth.

Cash is king

Any good business, and thus one worthy of consideration for portfolio inclusion, must generate ?shareholder value.? The tricky bit here is deciding what this means. In his book Making the Right Investment Decisions: How to Analyse Companies and Value Shares,? Michael Cahill asserts this is all about ?ensuring the business generates returns that compensate [investors] for the risks they are running. And in this regard, it?s important to remember that with shareholder value, the ROIC (Return on Invested Capital) must be greater than the Weighted Average Cost of Capital - (WACC) which is a calculation of a company?s cost of capital in which each category of capital is proportionately weighted.?

A strong competitive advantage, scalability and pricing power will show up in cash conversion rates. Expressed as a percentage, they are calculated through dividing net cash from operations by operating profit.

Free cashflow yield is another valuable tool for the holy grail hunter. This metric is calculated by dividing the free cashflow by the enterprise value, itself reached by adding debts, pension and lease liabilities to the market cap and then subtracting any cash and the value of assets for sale.

This focus on cash will also naturally lead the portfolio builder to firms with strong balance sheets as debt is the number one company killer. Even if a concern does not go bust, the interest payments on the liabilities to the lender siphon away cash that could otherwise go on developing the market share, brand or product strength which underpin a competitive position and thus pricing power.

This is an edited version of an article first published by Shares in September 2013.