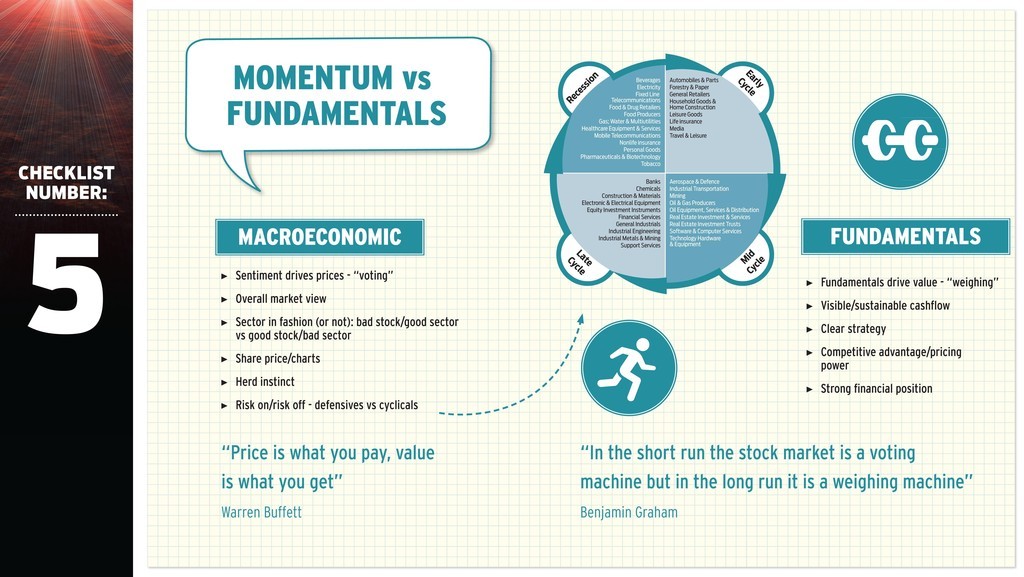

In stock market investment there are several timeless debates that are fated to run and run. There?s the battle between ?active? fund managers and their ?passive? counterparts, the struggle between technical and fundamental analysis but, arguably, more important and more interesting to private investors is the tug-of-war between momentum and fundamental investing.

(Click on following image to enlarge)

In essence, fundamental investors dig around the nuts and bolts of a businesses and its markets looking for attractive share price valuations that they believe will revert to ?normal? given time. Meanwhile, momentum fans buy stocks in companies that are perceived to be ?in the right place, at the right time? creating a tsunami of investor demand that they can jump aboard as share prices push ever higher (or lower if the momentum is negative). The first party takes a bottom-up approach, starting with the business, while the second seeks to gauge the mood of the financial market and investors? sentiment.

Many fundamentals purists have a tendency to dismiss the sentiment factor which they point out is based on nothing concrete. The market mood can change on a sixpence, and the often referenced ?wisdom of the crowd? can quickly turn into mindless herd mentality, they argue. Their faith is firmly planted in profit and loss accounts, balance sheets and cashflow statements.

SPLIT OPINION

But momentum players rightly point out that rejecting sentiment per se flies in the face of facts, hard evidence that market whim can produce stunning share price profits however capricious it may appear. It would have taken a very thick skin for an investor to have completely denied the temptation to put at least some cash into the internet boom of the late-90s, early noughties, however flaky most of those now-exploded stars looked at the time.

Equally, spotting the subsequent shift to supposed ?old economy? companies in late 2002 would have allowed a momentum investor to jump aboard out-of-favour stalwarts, British American Tobacco (BATS), for example, one of the big engines for the stock market recovery over the next four years.

Richard Driehaus, the Chicago money manager widely considered the father of momentum investing, summed up his approach nicely when, taking exception with the old stock market adage of buying low and selling high, he once pithily observed, ?far more money is made buying high and selling at even higher prices?.

But one of the trickier problems with momentum investing is that nobody really seems to know what it is, or the specifics that might flick the switch of market sentiment. Many academic studies have attempted to get to the bottom of this conundrum over the years, including what is widely considered to be the first comprehensive study of the momentum effect conducted by UCLA professors Narasimhan Jegadeesh and Sheridan Titman, published in 1993. They found strong evidence, over the 1965-1989 period, that stock prices trend, at least over short time frames of up to two years.

In an earlier academic study published in 1979, the behavioural tendencies of investors was investigated by future Noble Laureates, Daniel Kahneman and Amos Tversky. The study identified what the pair called the ?anchoring and adjustment? factor. Their findings suggested to the two economics professors that, in the face of uncertainty, individuals estimate the expected future value of an asset by making adjustments to a reference price, that is, an ?anchored? value. Investors manifest this tendency by anchoring to the current information (the share price) and being slow to adjust to expected future values in light of new information. Thus, prices lag fundamental information and play catch up for a few quarters, leading to serial correlation in stock prices. Jegadeesh and Titman also concluded that an under-reaction to firm-specific information was the likely cause of momentum.

RISK MEASURE

As valuable as academic studies can be, in simple terms, momentum investing appears to be at heart about risk, with investors either willing to take on more, or less, depending on a share price or market?s direction of travel. For example, between WANdisco?s (WAND:AIM) Aim IPO in June last year at 180p to early October 2012, when the shares hit 440p (+144%), precious little had really changed with the story. It had come to market with a suite of Hadoop-based applications (apps) and intellectual property (IP) aimed at the applications lifecycle management (ALM) market from which it earned bookings and revenues. And the company had stated from the get-go that investors could expect ?Big Data? products to follow.

By October we were still to see those Big Data products arrive (they were to start emerging in February), so what changed to fire such a share price hike? The market?s attitude to risk, essentially. Investors were clearly buoyed by positive trading (and a fairly important acquisition to be fair) and felt increasingly that the risk/reward see-saw had tipped in the latter?s favour. It?s been a similar story all year. Yes, important progress has been made in product launches, partnerships and new business, but we are still looking at a loss-making company until 2015 at the earliest, just as we basically were 15-months back, yet the shares last month (11 Sep) hit a record £11.75.

The same can easily apply to profitable, cash-generative businesses too. In April 2012 we flagged a buying opportunity in Cambridge-based print head technology developer Xaar (XAR) at 234p. We suggested that 340p was a completely realistic share price over a 12-18 month view, a level hit in early March this year.

But while a forward price/earnings (PE) multiple of 20 or so would have seen many fundamentals purists lock-in that 43% gain, how costly such a more would have proved. Within three months the shares had hit 600p, and they just kept on going, fuelled by a succession of positive trading updates from the company and optimistic analyst research. Just before Christmas they broke through the £11 mark. That?s momentum for you.

BLENDED APPROACH

Successful momentum investing relies on key judgement calls, spotting themes early enough, knowing when to take profits and how to identify the signs of slowing fundamental and technical momentum. By contrast successful value investing depends on hard graft to identify companies that are cheap and to boldly state that the market is wrong.

When in the stock market for the long-run, perceived wisdom suggests that investors should not get overly worried about daily share price fluctuations, market sentiment and news-based trading tips. Share prices will be driven by factors relating to company, industry and economy, the core fundamentals. When you are building an investment portfolio for the long term every stock selection should ideally be made only after careful fundamental analysis of the company?s financial performance, its growth prospects, whether it has a clear strategic plan, pricing power and sustainable cash generation, perhaps using a strengths, weaknesses, opportunities and threats (SWOT) analysis, something we regularly do in Shares. Other tools, a Porter?s Five Forces analysis for example, can be very useful in working out a company?s competitive advantages.

This is an edited version of an article first published by Shares in October 2013.