Budget gifts-to-greetings cards purveyor Card Factory's (CARD) interims are warmly received by the market, the shares rebounding 6.4p to 308.5p on the delivery of further profit growth amid softer high street footfall.

The retailer also reveals it will return £51.1 million via a special dividend on top of a meaty 12% hike in the ordinary payout to 2.8p.

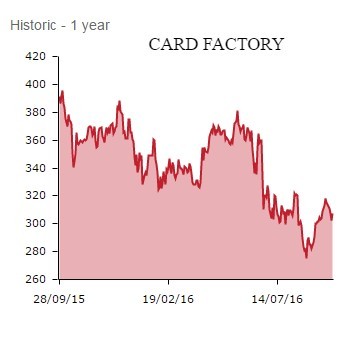

Shares has previously lauded the cash-generative qualities of the UK's biggest specialist greeting cards, dressing and gifts seller by some stretch, whose shares trade 37% above their 225p, May 2014 IPO issue price despite a recent wobble.

A vertically integrated model, spanning in-house design and printing, then retailing to the customer, is a key point of differentiation, reducing external costs the company can then pass on to customers. This model enables Card Factory to maintained industry-leading EBITDA margins north of 20% and underpins its copious cash generation.

New CEO Karen Hubbard reports pleasing 7.3% profit before tax growth to £27.6 million for the half to July, though like-for-like growth is muted at 0.2% and in fact, down 0.1% excluding the explosive growth generated by a new cardfactory.co.uk website.

'We have delivered a solid set of interim results with further growth in both revenue and profit, albeit with softer footfall resulting in slightly lower than normal sales growth from our stores,' comments Hubbard. 'We remain highly cash generative and are pleased to be announcing another special dividend of 15 pence per share. Together with the interim dividend, this means we will have returned over £160 million to shareholders since IPO just over two years ago.'

While improvements in the quality and range of card and non-card products delivered good ongoing growth in average spend, weaker footfall on the UK high street crimped sales growth across a store estate that now numbers 848.

'Trading in recent weeks has been similar to the trends seen in the first half, with encouraging continued growth in average spend,' insists Hubbard. 'We approach the important final quarter with confidence in the quality and value of our offer, including our new Christmas ranges, and remain confident of delivering full year underlying profit before tax within the range of expectations', consensus pitched at between £80.9 million-to-£83 million before today.

'As a consequence, we have seen no significant change in competition in the first half,' adds Hubbard, who remains 'as convinced as ever of the strong growth prospects for the business, and of our ability to deliver further returns of surplus cash to shareholders over the medium term.'