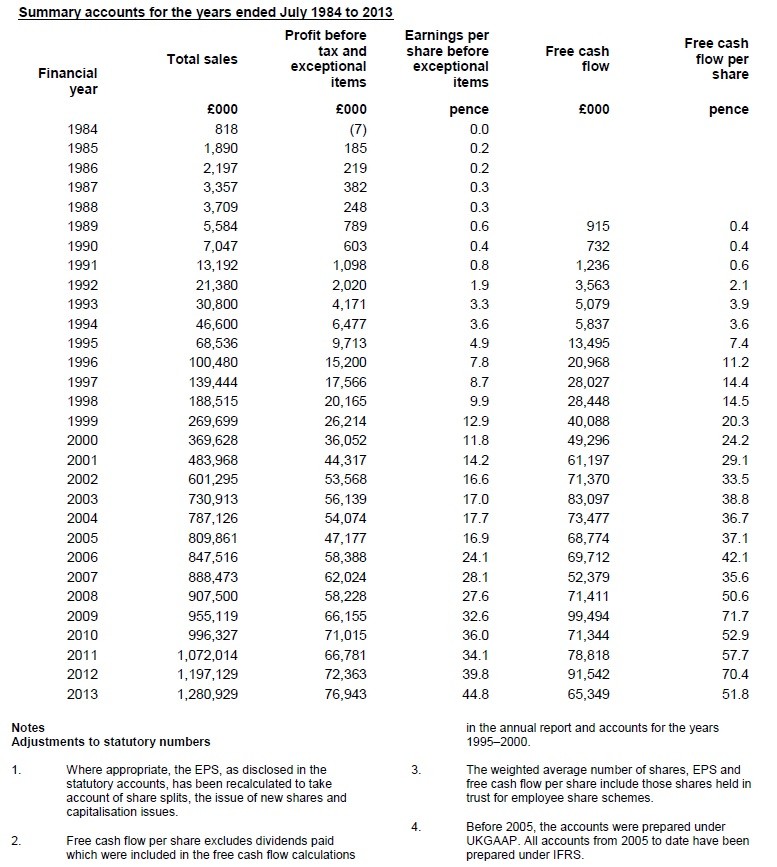

Pubs operator JD Wetherspoon (JDW) has published an interesting table of its historical sales, profits and free cash flow, as part of today's full-year results. As a business it has clearly done well over the years, chasing the value end of the market which helped it to prosper during the economic downturn. Yet it also shows how volatile profits and free cashflow have been for a long time.

While the post-recession years have certainly been more of a slog for the group, with profit margins under pressure, it still manages to report a record high pre-tax profit of £76.9 million (before one-off items). That's slightly better than expected. Investec had pencilled in £76.3 million. It reckons pre-tax profit will advance to £80.5 million in 2014 and £91.1 million in 2015.

Like-for-like sales grew by 5.8% in the year to 28 July. Since then, sales have increased by 3.6% in the six weeks to 8 September. In the past fortnight, they are up 2.5%. Wetherspoon says this level may be 'an indicator' for future sales growth.

It's the usual situation with results. A strong pre-close trading update triggered earnings upgrades and pushed up the share price. Now the figures are out, investors are taking profits as the shares fall 1.4% to 725p. With no dividend growth and a warning from the company about tax headwinds for itself and the industry, it is perhaps understandable that investors may want to bank some gains. That said, as a long-term play on the pubs sector, Wetherspoon is certainly a shrewd operator and a survivor.