While they will be pleased to see that markets are continuing to rally, investors need to tread carefully as some technical indicators still offer grounds for concern and it will be instructive to see what the USA does when it returns from the Presidents? Day holiday on Tuesday.

'Friday?s 2% bounce in America?s S&P 500 bounce is helping sentiment on this side of the pond today but the quality of the rally in the USA was poor, so we should be careful not to get too carried away just yet,' says Russ Mould, AJ Bell?s Investment Director.

Figures from the New York Stock Exchange showed that just 23 American stocks hit a new 52-week high on Friday, against 139 that set a new 52-week low.

'This suggests that breadth was weak and the gains came from just a select number of firms, so the foundations of the advance were not as strong as they could have been,' argues Mould.

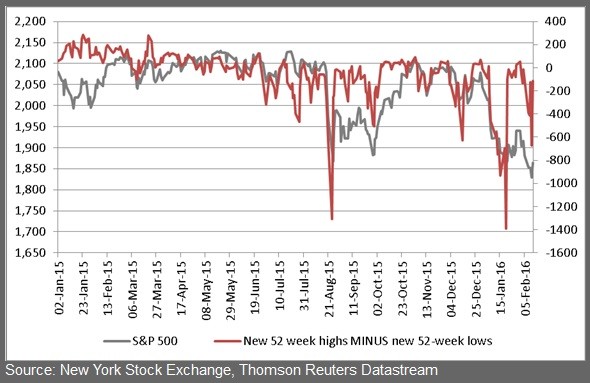

The chart shows the daily sum total of new 52-week highs minus new 52-week lows and shows the result against the S&P 500 index since 1 January 2015

This technical indicator has been weak for some time - in 2015, there were 20 more 52-week lows than highs on average per day, and so far this year that gap has grown to an average of 319 more lows than highs per day.

'Investors will want to see new 52-week highs start to close the gap and then begin to once more decisively outnumber new 52-week lows before they can draw real confidence from rallies in the US market,' Mould says. 'Since the world tends to follow America?s lead this is an important indicator which everyone could do to follow closely.'