Global food and drink concessions operator SSP announces its much-anticipated intention to float on London?s Main Market, despite fears the window for new flotations could be rapidly closing. Run by CEO Kate Swann, the respected former WH Smith (SMWH) boss, SSP offers investors a play on rising air and rail passenger numbers and burgeoning global travel infrastructure spend.

Long in the frame for an IPO, SSP, demerged from Compass (CPG) back in 2006, operates the best part of 2,000 branded coffee shops, sandwich bars, bakeries and takeaway restaurants in 29 countries, diversified across the UK, Europe, North America, Asia Pacific and the Middle East. The SSP model sees it run sites under concession deals with train station and airport owners via proprietary brands such as Upper Crust and Caffe Ritazza, as well as through franchise agreements for partner brands including Starbucks, Burger King, M&S Simply Food.

The self-styled 'food travel expert' services on average one million customers daily, consumers who are on the move, hungry for food and refreshments and not blessed with too many alternative sources of nourishment. SSP also runs outlets at motorway service stations, leisure sites and hospitals and is the group behind on-board rail catering business Rail Gourmet. SSP argues its deep understanding of a diverse customer base and changing trends, slew of brands and expertise in running outlets in often frenetic, high-volume travel locations has helped it forge a base of long-standing clients and brand partners as well as strong market positions.

Long-term structural growth drivers for SSP range from burgeoning passenger volumes - air passengers are forecast too double over the next twenty years - increasing spend per passenger in travel hubs, as well as the trend for airport and railway station operators increasingly looking to commercialise their sites.

Besides the presence of seasoned retailer Swann, who won plaudits aplenty during a decade at WH Smith, during which the travel division grew in importance to the newsagent, SSP has a number of investment attractions. These include high earnings visibility, derived from long-term contracts, as well as a high hit rate in retaining existing and winning new concession deals. New international customer wins over the past year range from Abu Dhabi International Airport and Beijing Capital International Airport to Bordeaux Airport and Bordeaux Saint-Jean Railway Station.

In today's missive, SSP flags an expected £500 million fundraising which will give the company an enterprise value of up to £2 billion, be partly used to pay down debt, as well as provide a partial exit for Swedish private equity group EQT and other shareholders.

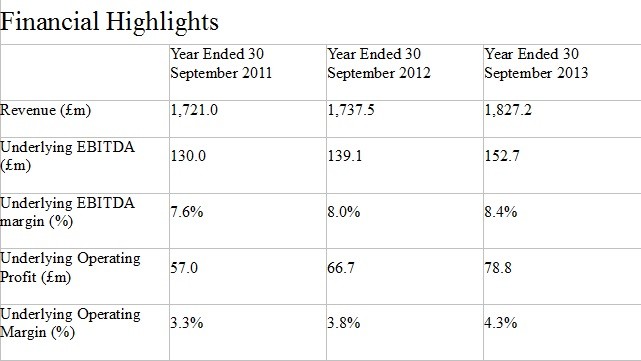

The statement also shows some encouraging financial metrics (see below), with operating profits rising 18% to £78.8 million on sales 5.2% ahead at £1.83 billion in the year to September 2013. Sales grew by a resilient compound average rate of 6.7% between the years to 30 September 2007 and 2013, while underlying EBITDA margins have improved as the global economy has recovered, increasing from 7.6% in the year to September 2011 to 8.4% for the 12 months to September 2013. SSP also says it will adopt a progressive dividend policy - the board has targeted an initial payout ratio of approximately 30 to 40% of underlying profits.