Today's trading update from Cardiff-based epitaxial wafer specialist IQE (IQE:AIM) doesn't exactly clear the operational fug. That the introductory paragraph concludes with the line that 'full year results will be announced 16 September' should immediately knock investors squiffy. The company's year end is December so a clear half-year/full-year mixed-up. For the record, half-year results will be announce 16 September.

Operationally, there are cons versus pros. 'First half revenues were impacted by destocking at a number of major customers due to softness in the handset market at the end of the year and into the start of 2014,' the company states, although it had previsouly warned of this. But 'coupled with the strength of sterling which also had an adverse translational effect.... the board expects first-half revenues of approximately £52 million, down 17% on the first half of 2013 (£63 million).'

That strikes a disappointing chord with the market, plunging the shares into a tailspin, falling around 10% in early trading, before the slide accelerated to more than 13%, leaving the shares trading at 20p, their lowest in over a year.

'It is a disappointing first half with revenues down 17% year-on-year despite an extra month of KOPIN in comparison,' spells out finnCap technology analyst Lorne Daniel.

Analysts at N+1 Singer concur, saying 'trading shows lower revenues than we had forecast, but earnings before interest, tax, depreciation and amortisation (EBITDA) better than we were expecting at £11 million,' up for 5% year-on-year.

For the record, analyst continue to forecast around £124 million of revenues for the full year to end December, so there's plenty to do.

Management claims that reshuffling the business has pushed through operating efficiencies, economies of scale, plus a better and sales mix have helped prop-up profits in the face of the top line squeeze. That bodes well for the second half and beyond, as does the company's view that the wireless market (largely smartphones and tablets) is showing signs of bouncing back, mainly thanks to 4G investment in China.

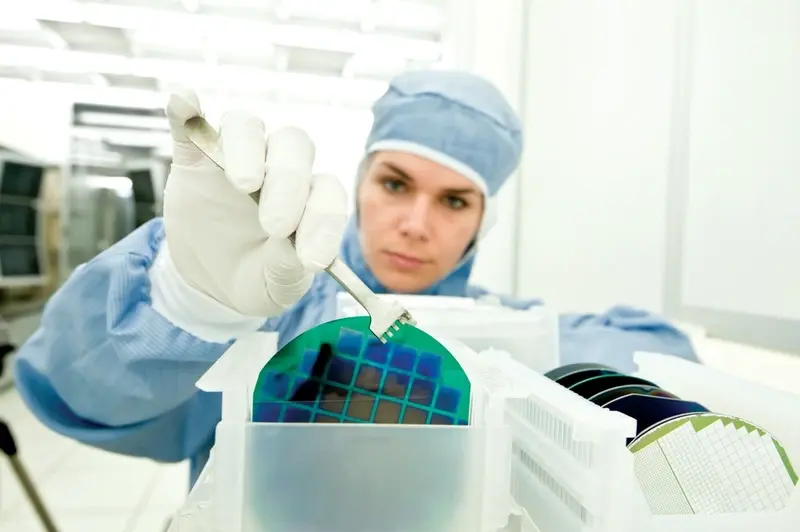

We'll have to wait and see it that optimism proves accurate, but more important to the company long-term health, and its future share price, is ongoing diversification into new markets, including vertical-cavity surface-emitting laser (VCSEL) technology, used in fibre optic cabling, storage, even gesture recognition, gallium nitrate (GaN), and solar in particular.

It is in solar that IQE's compound photovoltaic (CPV) technology is showing promising signs after several years of investment, a point made by Shares 9 January. This area is now moving towards the production phase and with CPV costs now roughly on par with other renewable energy types (wind, hydro etc) solar energy could prove a big opportunity. Analysts at Canaccord have their fingers crossed and believe revenues are cloe to ramping-up.

'We believe opportunities in emerging technology markets (GaN, VCSELs, CPV) are not factored into the current price,' concludes Canaccord. 'We maintain our Buy recommendation and 35p multiples-derived target price.