This is one of the most popular investment trusts with retail investors. FTSE 100 member Scottish Mortgage (SMT) has been a real wealth creator over the years yet the trust’s share price has taken a hefty beating as investor nerves have been shredded in recent weeks.

Having hit a record high of 568.3p on 3 September, the stock lost 20% of its value by 11 October, down at 454.4p. Having bounced a little since then the trust’s share price has once again come under selling pressure, the share price drifting around 0.5% lower today to 481.1p.

Why has this typically hot stock suddenly gone so cold?

WHAT MADE IT HOT

Scottish Mortgage has an excellent track record for value creation over the longer-term. In the last 10 years net asset value (NAV) has soared 383% while the share price has done even better, increasing 453%. Part of that is down to the stock’s rough 5% discount to NAV evaporating entirely to trade at a premium.

This performance is significantly better than its benchmark FTSE All-World reference index, which according to analysts at broker Stifel had returned 186% as of 31 August.

3 REASONS WHY IT HAS CAUGHT A COLD

There are a number of reasons why Scottish Mortgage has been sold down of late, but three in particular stand out; growth exposure, a concentrated portfolio and ratcheting up its stakes in private companies not listed on stock markets.

Scottish Mortgage’s remit is to invest in ‘a high conviction, global portfolio of companies with the aim of maximising its total return to shareholders over the long term’.

THE GROWTH BUG

This has resulted in the trust owning a portfolio primarily of high growth stocks, many of which are highly rated on conventional valuation measures. At times, when there is a questioning of valuations, or rotation away from growth and technology companies, parts of the portfolio can come under selling pressure, which causes sharp share price de-ratings.

Of course, it works the other way too, which has played well for Scottish Mortgage in recent years, but the current climate is very much shifting to risk-off on growth.

CONCENTRATED PORTFOLIO

While many investment trusts hold a broad spread of investments that provide wide diversification (some own up to 100 separate stocks), Scottish Mortgage invests differently. It doesn’t want lots of decent companies' stocks, but a relative handful of what it perceives as excellent ones. That’s its high conviction approach at work.

The trust currently has just 41 quoted investments in the portfolio and the largest 30 accounted for 88% of NAV, as of 31 August. The five largest are worth 39% of NAV (Amazon 11.6%, Illumina 8.8%, Alibaba 6.4%, Tencent 6.3% and Tesla 5.5%).

The portfolio concentration can magnify Scottish Mortgage's returns relative to other more diversified investment trusts. The results of this strategy have been demonstrated in a positive way in recent years.

INCREASED UNLISTED EXPOSURE

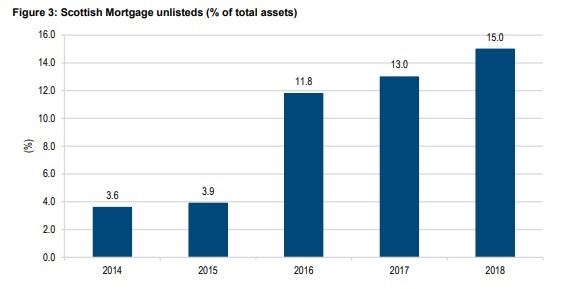

Following the shareholder approval for Scottish Mortgage to invest up to 25% of assets in ‘companies not listed on a public market’ in June 2016, the proportion of the portfolio in unlisted companies has ballooned from 4% of total assets in March 2015 to 15% at the end of August.

On the one hand stakes in unlisted companies should reduce volatility in Scottish Mortgage's NAV since they are revalued on an infrequent basis.

But there is a sting in the tail. When markets become spooked investors tend to react first and think later. Anticipating a risk of future impairment on some unlisted valuations, that sort of investor mood swing can act as an extra brake on the trust’s share price, dragging on stock performance in the short-term.

WHY THE FUTURE REMAINS BRIGHT

We continue to see a bright future for Scottish Mortgage over the longer-term even if there will inevitably be spells of volatility for the share price. As we explained in a recent feature, the trust’s managers benefit from deep relationships with investee companies, and so you can be reassured they have the power to engage with, and hopefully influence, businesses that may have some ‘delicate’ issues.

Fundamentally this investment trust will give your portfolio exposure to strong growth stories around the world, with low charges and a highly experienced fund management team. ‘We rate it as a must-have for anyone in the accumulation phase of their investing career.'