Ahead of a meeting later today with analysts to spell out in detail its new medium terms plans, IG (IGG) has released a summary of its new medium term goals, which see revenues growth of 30% by 2022. This contrasts markedly with current expectations for falling revenues, giving the shares a boost of 14% to 542p.

READ MORE ABOUT IG GROUP HERE

While extra investment will be required to deliver incremental growth, the company has reassuringly stated that the dividend will be held steady at 43.2p per share until the groups’ earnings allow the resumption of the progressive dividend policy.

CORE MARKETS BACK TO GROWTH

The group has re-categorised its business into two groups, core and 'significant opportunities'. Core markets include; UK, EU, Australia, Singapore and non-EU EMEA (Switzerland, Dubai and South Africa).

The group will become more focused on local initiatives to leverage the brand in these markets and expects medium-term growth to be in the 3% to 5% range.

Revenues from core markets are guided to be £415m for the year ended 31 May 2019.

SIGNIFICANT OPPORTUNITIES

From an estimated £60m for the year ended 31 May 2019, revenues from 'significant opportunities' are expected to grow by more than 35% a year to £160m by 2022. The company defines 'significant' growth markets as new segments within Europe, the USA, Japan and other Asia.

In Europe it is expanding into new products including options through its multilateral trading facility (MTF). An MTF is an alternative exchange which offers trading in instruments that are not listed on an official market.

In Japan the company will create more localised products and marketing, while in other Asian markets it will develop partnerships to gain access.

IMPROVING SHORT TERM TRENDS

IG highlighted that the first three weeks of May were more favourable and as a result, revenue in the fourth quarter was expected to be around £115m compared with £108m in the previous quarter.

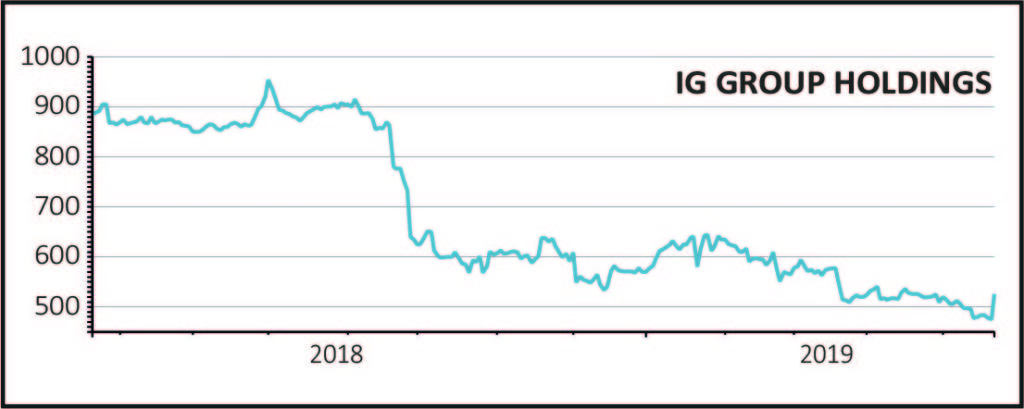

The company guided today that it expects revenues to be £475m for the year ended 31 May 2019, down 17% from last year, with operating profit of around £190m.

The group's operating costs for the year ended 31May 2019 are expected to be around £285m, a slight improvement on the previous year's £290m.