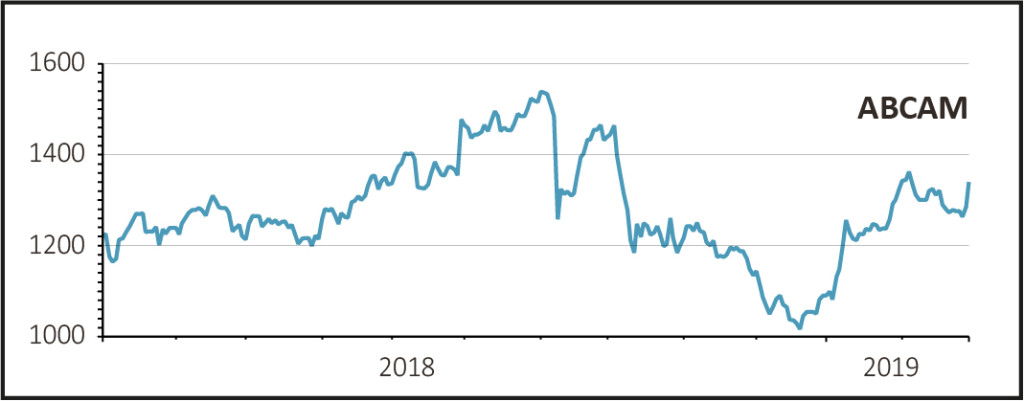

Shares in life science research tools supplier Abcam (ABC:AIM) have slumped by 16% to £11.25 after first-half sales growth missed expectations and it says there will be no improvement in sales growth in the second half of the year.

Sales for the six months to 31 December 2018 grew by 10%. Analysts had forecast 11% growth.

The company is also downbeat on its outlook as it warns of continued softness in Japan and the impact of anticipated phasing of sales in custom products and licensing (CP&L).

READ MORE ABOUT ABCAM HERE

The stock was trading at more than 30 times earnings before today’s news. In general, stocks on high ratings fall hard on the slightest bit of bad news.

‘In our view, the significant (share price) premium is unjustified given the moderate growth rate and risks associated with the change in business model towards CP&L and structural changes underway,’ says Panmure Gordon analyst Julie Simmonds.

WHY IS TRADING WEAK IN JAPAN?

Japan, which represents 6.5% of group sales, has been struggling with lower funding and demand for life science products.

Chief executive officer Alan Hirzel says the company does not know when conditions in Japan will turn around and hasn’t clarified what actions are being taken to address lower sales.

Abcam aims to achieve double-digit constant currency revenue growth, ahead of underlying market growth. In Japan, sales are shrinking in the mid-single digits according to the company.

China was once again its fastest growing market as sales soared by 22% over the second half of 2018.