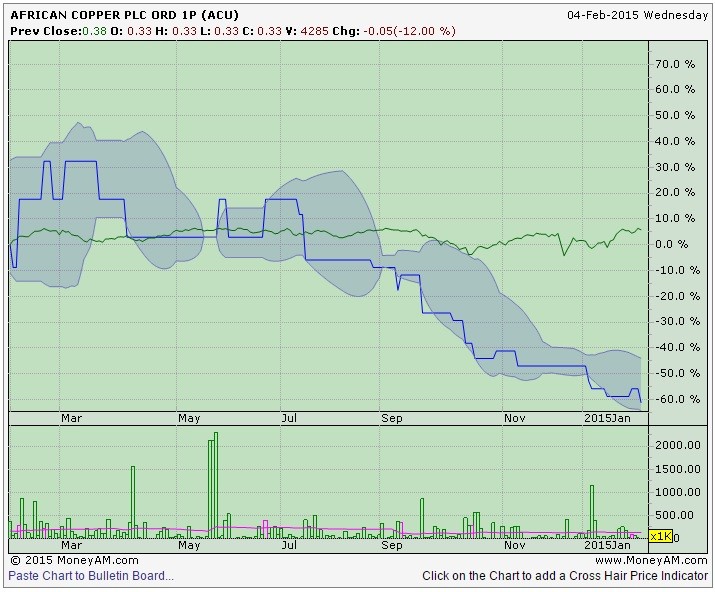

The crash in the copper price this year has seen Botswana-based African Copper (ACU:AIM) return to its old days of financial distress. The small cap metals producer is once again being kept alive by 73.44% shareholder ZCI with a new loan to cover working capital requirements. It has also been forced to cut back on some mining operations and admits there's a limited window of opportunity for restructuring the business for long term sustainability'.

The market is understandably nervous about the company's future, hence the shares crash 33% to 0.252p on the news. In reality the stock has been uninvestable for many years. ZCI controls so much of the business that there's barely any shares traded in the market, hence it is highly illiquid. It is almost entirely owned by ZCI when you include equity and debt.

It's also no secret that the Chinese company has wanted to get rid of its shareholding for some time. As we wrote in a feature last year, this is arguably the biggest share overhang on AIM. It effectively had no choice but to pump more money in the £4.5 million cap today, otherwise African Copper could have gone bust and wiped out ZCI's investment completely.

African Copper owes ZCI an astonishing $105 million. It claims to now have enough cash to keep operating for six months. The clock is therefore ticking on revamping mining operations and securing long-term funding, otherwise it is game over the business.

We recently wrote about the perils of the copper price in Shares - you can read that article here.