Credit hire and legal services provider Anexo Group (ANX:AIM) delivered a significant increase in half-year revenues and earnings thanks to an increase in vehicles on hire and an increase in cash collection from its legal team.

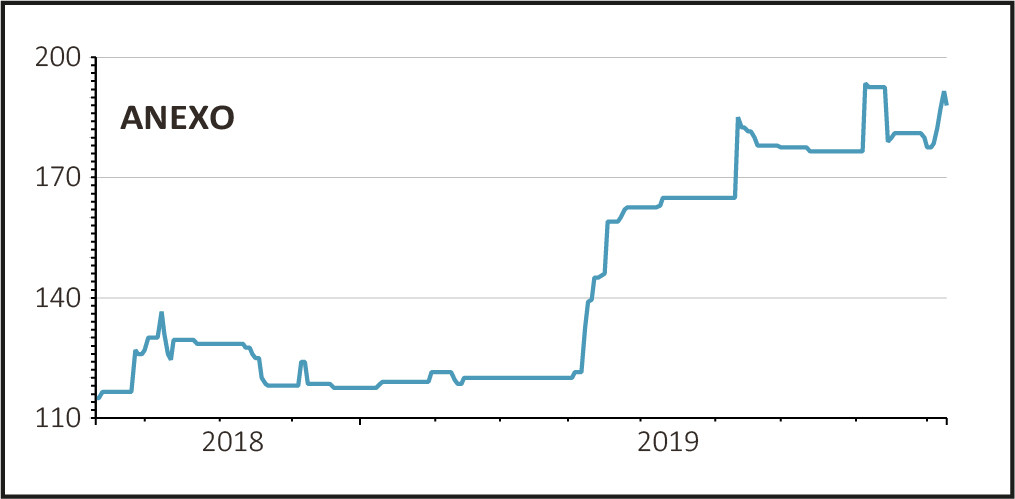

Revenues for the six months to end-June rose 55% to £36.7m while cash collection grew by 30% to £36.6m and pre-tax profits grew by 63% to £11m. After a strong performance over the last month, the shares eased back 1.8% to 188p.

Anexo shares rose sharply at the start of August after the firm revealed that full-year pre-tax profits would ‘significantly exceed market expectations’, which stood at £20m at the time. Management now expects profits to hit analysts’ revised estimates of £23m.

As well as growing its revenues and cash collection, Anexo has renegotiated its working capital facilities resulting in a ‘considerable improvement’ in its financing costs and agreed new terms with its vehicle fleet insurers which will bring more cost savings this year and next year.

READ MORE ABOUT ANEXO GROUP HERE

Anexo provides vehicle hire for not-at-fault drivers who are involved in an accident and who need a replacement car, van or motorcycle. The claimant’s vehicle is taken to an approved repairer and they are supplied with a hire vehicle for the duration of the claim.

The at-fault driver’s insurance company picks up the bill for the repairs and the hire cost of the replacement vehicle, all handled by the legal team at Bond Turner, so the claimant gets an end-to-end service.

The average number of vehicles on hire in the first half was just under 1,500 compared with just over 900 the previous year. Motorcycle hire has been a particularly successful niche, especially with courier firms who have to have a replacement bike the same day if one of their riders is involved in a no-fault accident.

Meanwhile Bond Turner, the legal services division, has out-performed management’s expectations with the new Bolton office breaking even just four months after it opened.

Both the number and the quality of litigators recruited has exceeded expectations, driving cash collection, while a focus on higher-value cases from the existing portfolio is driving profits higher.

Cash collection grew by 30% in the first half and the strong trend carried on into July which looks like it could be a record month. It’s worth noting that experienced litigators tend not to reach capacity in terms of settlement and cash collection for 12 months so there is potential for more good news to come on the legal services front.