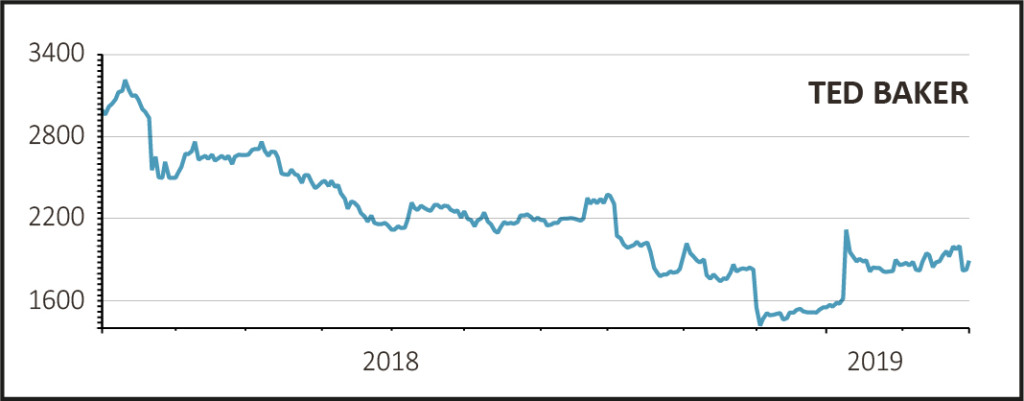

Fashion retailer Ted Baker’s (TED) shares continue to shed value, off another 4.8% to £18 after founder and chief executive officer (CEO) Ray Kelvin has resigned.

His immediate departure comes following a company probe into 'hugging' claims made by some employees.

This is the latest setback for the quirky British fashion label following a series of downgrades and then a profit warning blamed on currency fluctuations, higher costs and stock write-downs.

READ MORE ABOUT TED BAKER HERE

Liberum Capital views the resignation as ‘unfortunate but understandable’, yet the broker foresees ‘minimal disruption’ ahead considering Kelvin ‘leaves the business with a strong team’.

CREATIVE INSPIRATION DENIES DISTURBING CLAIMS

Ray Kelvin CBE is the creative inspiration behind Ted Baker, having founded the business as a single shirt specialist store in Glasgow over 30 years ago. Yet Kelvin, also the company’s largest shareholder, took a voluntary leave of absence from his role in December after allegations of misconduct were made against him.

Law firm Herbert Smith Freehills (HSF) has been investigating the allegations against Kelvin, which it is important to stress he denies, while poring over the company’s policies and procedures for handling human resources (HR)-related complaints. HSF is set to conclude its investigation at the end of the first quarter or early in the second quarter of this year.

TED’S DEEP BENCH

Thankfully for shareholders in the self-styled ‘global lifestyle brand’, acting CEO Lindsay Page has agreed to continue in this role, with Non-Executive Chairman David Bernstein to act as Executive Chairman until November 2020 in order to provide Page with additional support.

Bernstein comments: ‘Ray Kelvin founded the business 32 years ago and has, together with the fantastic team around him, been the driving force behind it becoming the global brand it is today. As founder and CEO, we are grateful for his tireless energy and vision. However, in light of the allegations made against him, Ray has decided that it is in the best interests of the company for him to resign so that the business can move forward under new leadership.

'As a board of directors, we are committed to ensuring that that all employees feel respected and valued. We are determined to learn lessons from what has happened and from what our employees have told us and to ensure that, while the many positive and unique aspects of Ted’s culture are maintained, appropriate changes are made.’

THE EXPERTS' VIEW

Here is the Liberum Capital take on today’s unsettling development: ‘It is disappointing to see a founder leave the business and brand that he founded. However Ray Kelvin leaves Ted Baker with a strong team and culture.’

‘The brand has grown steadily from its origins since 1988 and the team at Ted Baker is one of longevity. Ray’s decision to resign will see the business move forward under new leadership but we are encouraged that the board has acted in a positive manner and will be providing additional support to the executive team.’

Russ Mould, investment director at AJ Bell, explains: ‘Quirky British retailer Ted Baker is probably hoping the resignation of founder and chief executive Ray Kelvin in the face of harassment allegations can provide it with a clean break and enable it to move forward. It may not prove that simple.’

‘For one thing it is not yet clear what lasting damage the episode has done to the Ted Baker brand and, for another, Kelvin himself has been inextricably linked with the development of said brand. Shareholders may legitimately ask what is Ted Baker without him?’

‘Meanwhile in the background an independent committee continues to look into the allegations and the culture at the group and Kelvin himself still owns a 35% stake in the business.’

‘If Ted Baker’s recent struggles continue, and it warned on profit just last week, will there be a clamour for Kelvin to return, despite the scandal, and turn things around?’

The news that acting chief executive Lindsay Page and executive chairman David Bernstein will remain in their roles provides a measure of stability, but if no permanent successor to Bernstein were to be appointed until the November 2020 deadline outlined today, or even close to that date, it would rather leave the business in limbo’.