A swathe of director selling at UK firms might be cause for some caution for shareholders. The last few days have seen multi-million pound disposals of shares by the head honchos at a trio of London-listed companies.

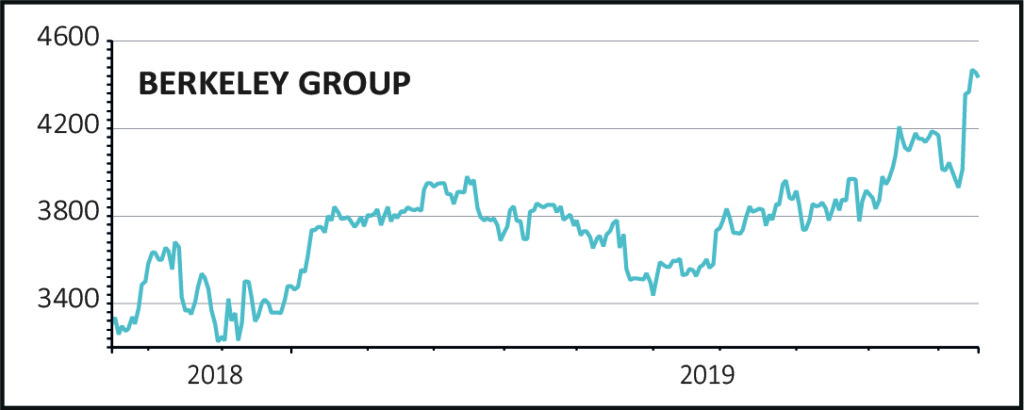

Notably all three have a domestic focus, suggesting there could be a link to the current uncertainty over Brexit. The latest instance of selling is also the most significant as the chairman and founder of housebuilder Berkeley (BKG), Tony Pidgeley, sold a whopping £42m worth of shares (16 Oct).

This takes the total value of shares sold by Pidgeley in the last three months to £80m, although he still has a substantial stake worth more than £120m.

Investors are likely to take particular note of this activity given Pidgeley has an excellent reputation for calling the housing market. Notably the company was very clear that its profit had peaked in the year to April 2018.

The next-largest sale is by Next (NXT) chief executive Simon Wolfson, who like Pidgeley is seen as being good at forecasting the weather in his industry.

Wolfson has offloaded £10m worth of stock (15 Oct) - some 10% of his holding in the company.

Next is one of our key selections for 2019 and the shares have enjoyed a strong run this year as it has outperformed low expectations.

Directors could have various reasons for selling shares - it could be the result of a change in their personal circumstances, perhaps an expensive divorce, or maybe they want to fund a big property purchase.

In Wolfson’s case the money will reportedly be ploughed into an unnamed private business which operates outside the retail sector. In fairness, this is the first time he has sold any of his shares in seven years.

Finally the chief executive of merchant bank Close Brothers (CBG), Preben Prebensen, has divested £3.2m worth of shares. Prebensen announced he would step down after a decade in the role in September when the company reported a 3% fall in profit for the year to 31 July 2019.