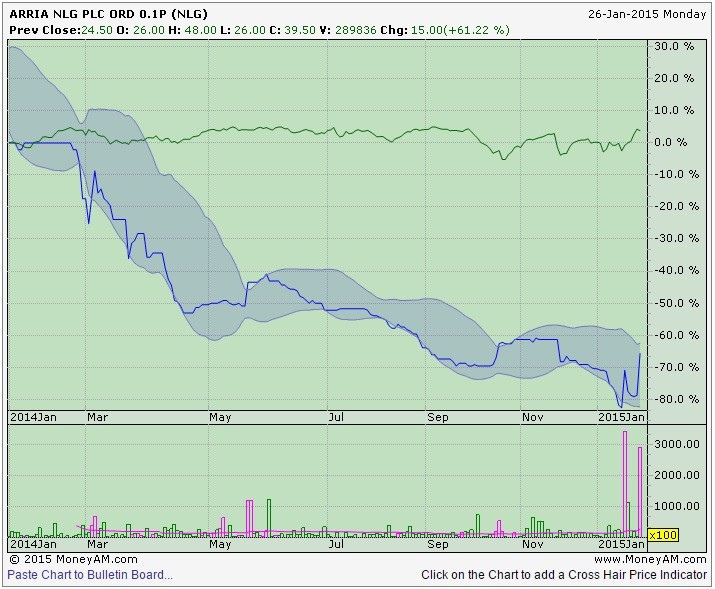

You don't have to be Sherlock to recognise the coup that today's Watson deal is for Arria NLG (NLG:AIM). It's certainly got investors excited, the shares jumping 65% on Monday to 40.5p. Teaming up with the cognitive systems arm of 'Big Blue', or IBM (IBM:NYSE) to use its proper name, could lead to exciting new computing breakthroughs, maybe.

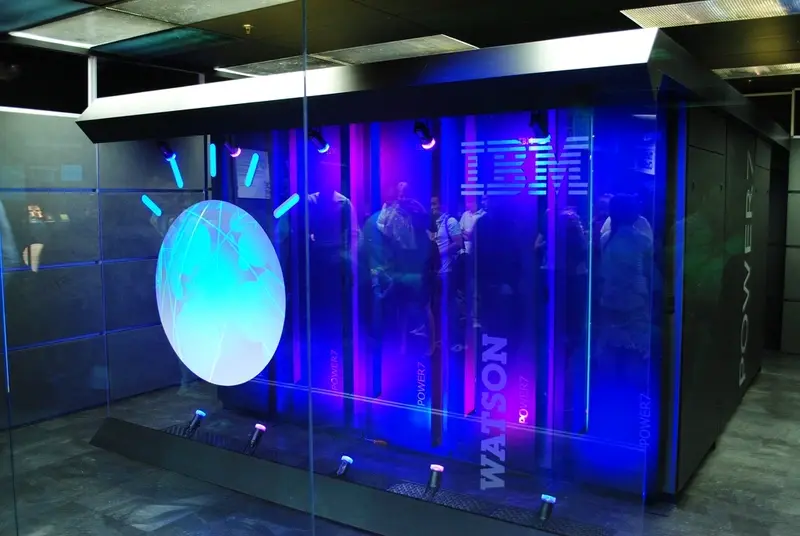

Watson is effectively IBM's answer to future computing, using hypothesis generation, dynamic learning and natural language to think more like a human than a machine. It's a fascinating branch of computer science, and one where Arria has developed some very interesting natural language generation technology of its own.

But fascinating does not earn revenues and there is a very real risk that neither will this partnership. Arria is currently trading on more than 30-times the piddling £2 million of revenues forecast for 2015 after today's leap but is still roughly 40% below its £102 million IPO value in barely more than a year. It is also still saddled with the same old challenges. It's very small, relies on barely a handful of customers, mainly in the battered oil industry, and is burning through wads of cash, more than £7 million last year to end September. It has £1.7 million left on its books which means investors can expect another cash call soon, possibly before April Fool's Day. Sheer luck may play a big part in Arria's future success hopes.