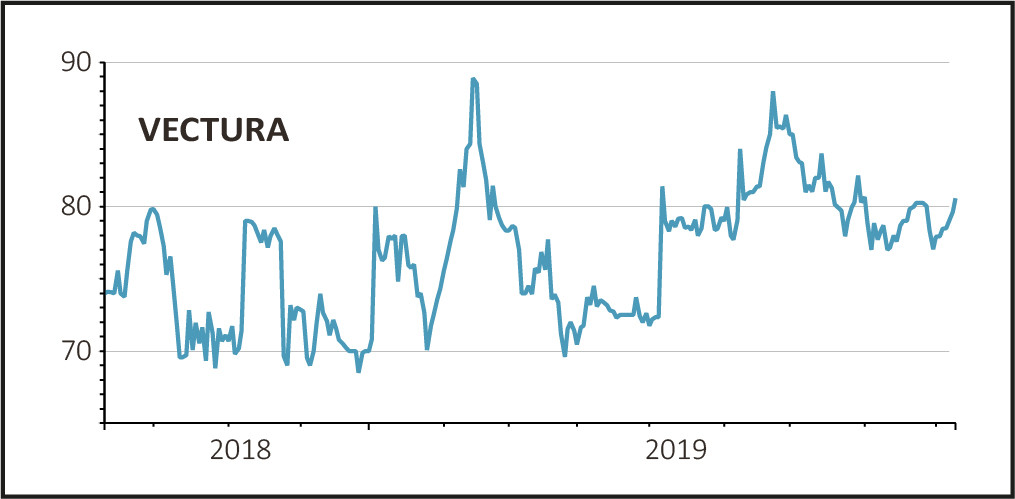

Drug delivery solutions company Vectura (VEC) reported strong first half growth in revenues, up 14.8% to £91.7m along with an increase in the proposed return of capital from £50m to £60m. The shares puffed up 1.9% to 81p.

Product supply revenues saw a 42.9% increase to £54.3m while the expiry of the company’s pain management drug Exparel in 2018, impacted royalty revenues, which fell 16.5% to £30.3m. The drug development division saw a 26.8% uplift in revenues to £7.1m.

FLUTIFORM FLOURISHES

The company’s asthma drug Flutiform continued to overall drive sales, with revenues up 12.2% in constant currencies to €123.6m, against a market backdrop which saw a decline of 3.5%. The company receives a mixture of royalty income (£3m) and product delivery income (£48.4m) from these end market revenues.

Interim chief executive Paul Fry said ‘Vectura has had a strong first half in 2019, with the year as a whole tracking to guidance. Following the shift in focus we announced in July, we are now executing on our strategy to build a leading inhaled contract development and manufacturing business’.

READ MORE ABOUT VECTURA HERE

Given the good visibility of Flutiform revenues, the company expects strong performance to continue into the second half of the year.

Vectura intends to focus on organic growth which has a lower risk profile and lower research and development needs.

Therefore, given the £104m of net cash on the balance sheet management have proposed to pay a special dividend of approximately £40m, accompanied by a share consolidation.

The board intends to undertake a further £10m share buyback, to be announced in due course, if approved by shareholders.

The total capital payment represents around 10% of the current market capitalisation.