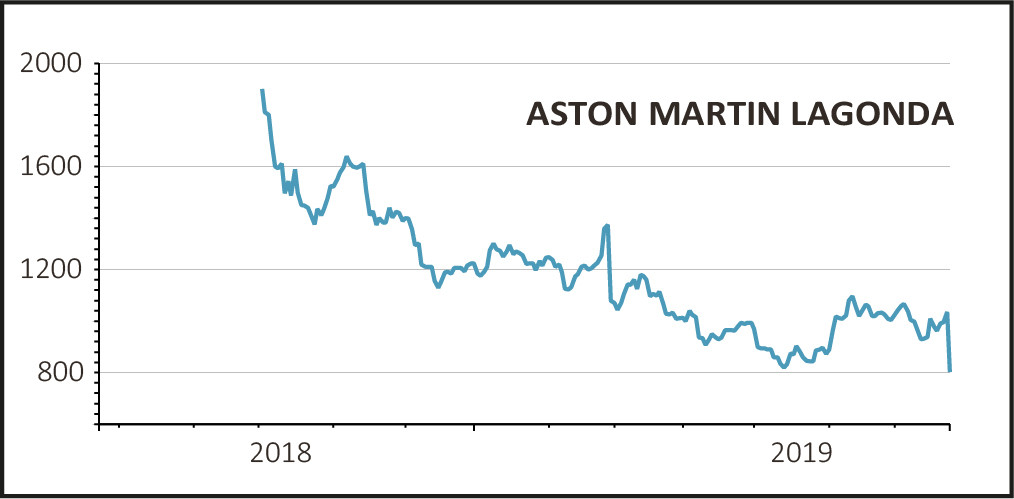

Shares in luxury sportscar-maker Aston Martin Lagonda (AML) were sent into a spin on Wednesday after the company lowered its outlook for the full year due to a worse trading environment since its last update in May.

Aston Martin shares hit a new low, down 23% at 798p, on higher than average volume. The shares floated at £19 last October.

The shares had been buoyed recently due to a firm cash offer from the company’s main shareholder Investindustrial. The Italian private equity firm, which already owns around 31% of the stock, offered to buy another 3% of the company at a price of £10.

READ MORE ABOUT ASTON MARTIN HERE

Due to the fact that ‘the challenging external environment highlighted in May' has worsened and the company sees no chance of it improving during the rest of 2019, AML has cut its target for wholesale deliveries of cars to between 6,300 and 6,500 this year.

It had previously planned to deliver between 7,100 and 7,300 vehicles this year. Last year wholesale volumes reached 6,441 units, an increase of 26% thanks to a 44% jump in deliveries to China and a 38% rise in deliveries to the Americas.

EUROPEAN BUYERS HIT THE BRAKES

Demand in China and the Americas still seems to be robust, delivery what the company calls ‘strong growth’, but the UK and European markets have decelerated further since the first quarter.

Deliveries to Asia were up 17% in the second quarter compared to 30% in the first quarter, while deliveries to the Americas were up 83% compared to 20% in the first quarter.

Offsetting this, deliveries to the UK were down 22% in the second quarter against a drop of 9% in the first quarter and European deliveries were down 28% in the second quarter against a drop of 4% in the first quarter.

MARGIN FORECASTS LOWERED

As well as lowering its delivery target, AML has cut its full year operating margin targets quite drastically.

Adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) as a proportion of sales are now expected to be around 20% instead of 24% and earnings before interest and taxes (EBIT) as a proportion of sales are expected to be 8% instead of 13%.

It has also taken the decision to write off all the income it expected to receive from a consultancy agreement as ‘the commercial position on this contract has deteriorated with significant doubt remaining over the outstanding receivable’.

In its 2018 accounts the company booked £20m of ‘other income’ from consulting. It will now take a large provision to reverse this item in its half-year results which are due to be published on Wednesday 31 July.