The days when the word banking seemed synonymous with price-fixing and requiring taxpayers money to stay afloat may be behind us. In the last 48 hours, two banks that needed bailing out, Lloyds (LLOY) and the Royal Bank of Scotland (RBS), seem to have turned a corner.

However, signs that reputational damage can run deep is perhaps shown with the market reaction to Barclays (BARC) results, released today.

Lloyds results yesterday signalled that it may return to its hay day of paying bumper dividends.

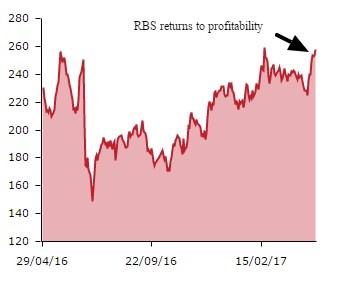

The Royal Bank of Scotland is still 72% owned by the state, although today’s results showing a return to profit has lifted its share price by almost 2% to 258.4p. The bank has turned a £968m loss this time last year to getting back in the black to the tune of £259m in the first quarter of this year.

Conduct question

Broker Investec Securities said on 24 April that it would not change its expectation of a 10th consecutive annual loss for the bank in 2017 as its consistent with guidance. In February, the bank recorded its ninth consecutive annual lose, down £7bn. This figure included £5.9bn on conduct charges and £2.1bn in restructuring fees.

It also set aside £3.1bn in anticipation of further fines from US regulators on the mis-selling of mortgage-backed securities (MBS) which may still hit the bank. Deutsche Bank was fined $7.2bn at the start of the year for its conduct over MBS selling before the financial crisis of 2008. US regulators have a long memory.

RBS has notched up an eye watering amount of losses, over £50bn in eight years. A return to profitability is a start but not time to get out the balloons just yet as the bank is not expected to pay any dividends in the foreseeable future.

Reputational problems

Barclays, whose group profits before tax doubled compared to the first quarter of last year, has not impressed investors as its share price is down by over 5% to 212.65p.

The bank has seen its net income hit by £1.2bn of loan and impairment costs, including £658m after tax relating to the sale of Barclays Africa.

Its former chief executive Bob Diamond left the bank after allegations of rigging the London Interbank Offered Rate (LIBOR) which is the rate at which banks can lend to each other. Unfortunately, his replacement James Staley has also been plagued by reputational problems after going on a hunt for a whistleblower.

Barclays and RBS are returning to loan growth and also trading at a discount to net asset value. A bargain perhaps but the banks paying the highest dividends, Lloyds and HSBC (HSBA), are also the most expensive.

If Barclays and RBS can improve their public image and continue to improve performance they may become investor favourites again. Although it doesn’t look like they’re quite there yet.