Following a letter from the Prudential Regulatory Authority (PRA), the Bank of England’s regulatory body, the UK’s biggest banks have agreed not to pay any dividends this year and to suspend their share buyback programmes.

The letter, which went to the seven largest ‘systemically important UK deposit-takers’, also asked the banks and the Nationwide building society not to pay any outstanding dividends for 2019 or to pay any cash bonuses to senior staff.

The move by the PRA follows guidance from the European Central Bank (ECB) that the continent’s banks should hold off from paying dividends until October at the earliest. The letter also contained a warning that ‘the PRA stands ready to consider use of our supervisory powers should your group not agree to take such action.’

MORE PAIN FOR INCOME-SEEKERS

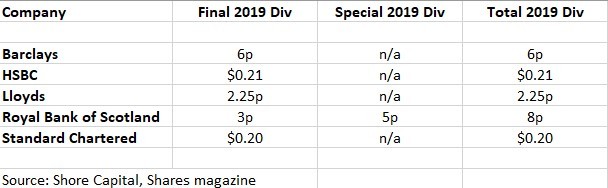

According to AJ Bell’s investment director Russ Mould, UK banks Barclays (BARC), HSBC (HSBA), Lloyds (LLOY), Royal Bank of Scotland (RBS) and Standard Chartered (STAN) were expected to pay a total of £15.6bn to shareholders in the form of ordinary and special dividends for 2019.

Yields on the banks were over 10% in most cases with RBS theoretically yielding 15% before today’s announcement.

However, having injected billions of pounds of liquidity into the banking system to help the banks to support the economy, the last thing the regulator wanted was for banks to use those funds to pay dividends to shareholders or engage in buybacks.

Today’s announcements mean that £7.5bn of 2019 dividends are no longer going to be paid out and another £7bn of 2020 dividends, or half of the total pencilled in for this financial year, will also likely be withheld.

WELL CAPITALISED

The one bright spot, which won’t be much comfort to investors today, is that the banks are much better capitalised and have much better balance sheets than in the global financial crisis.

By holding onto their 2019 and 2020 dividends, there is also less risk that they will need to come to the market to raise capital in order to offset asset write-downs and bad loans.

Having said that, while it agreed to cancel its dividends and buyback, HSBC warned that while its credit performance had ‘held up well’ in the first quarter, the impact of coronavirus on interest rates and the global economy meant revenues would be lower while provisions for write-downs and bad loans would increase. Shares in HSBC were down 9.7% to 410p.

PRA chief executive Sam Woods also wrote to UK insurers regarding the distribution of profits and executive bonuses, saying it expected them to pay ‘close attention to the need to protect policyholders and maintain safety and soundness’ in order to help support the economy.