THIS IS AN ADVERTISING FEATURE

The world as we know it is changing at a rapid pace. Over the next decade, we expect five key megatrends to shape our future namely - (1) technological innovation, (2) ageing demographics, (3) shifting power of Emerging vs Developed markets, (4) climate change and (5) urbanisation. The coexistence of two of these megatrends - technological innovation and climate change are driving the advancement of battery technology. The rapid advancement of battery technology is enabling a radical energy transition. Primarily since it is solving the problem of lowering global carbon emissions alongside reaping the benefits of rapid technological innovation.

Impact of Policy Change

Political will has been the cornerstone of the shift to electrification. Across the world we have targets for limiting the climate damage. The Paris Agreement’s long-term temperature goal is to limit the increase in global average temperature to well below 2°C above pre-industrialised levels and to pursue efforts to limit the increase to 1.5°C, recognising that this would substantially reduce the risks and impacts of climate change. The agreement includes commitments from all major emitting countries to cut their climate-altering pollution and to strengthen those commitments over time. Britain is on track to exceed its 2020 goals of reducing greenhouse gas emissions by 37% and reduce the level of nitrogen oxides in the air by 55% compared to 2005 levels.

Batteries are a key enabler of the energy transformation story

The most dominant solution for battery technology today is Lithium ion batteries (LiB) - it was first developed by Sony in 1991. It took 20 years of research and development to get to that point. The reason for the dominance of Lithium ion batteries is due to its useful attributes such as high energy density, good charging and discharging properties.

Initially they were used in small scale applications like consumer electronics - cell phones, laptops and e-bikes. From then on, they were used in larger application including electric vehicles (EVs) and storage in power markets. EVs need a portable electricity source which batteries can provide.

Similarly, in the power markets, renewable sources of electricity including wind and solar are intermittent, which makes it difficult to match the demand for electricity with the instability in the supply of power from natural elements. Batteries enable the storage of excess power production which can be released at times of higher demand. Battery storage can help smoothen supply and improve grid stability. This type of energy storage is often called stationary.

EVs are likely to be the strongest source of growth for batteries. Even under conservative demand growth forecasts for EVs according to Wood Mackenzie battery demand from this sector is likely to eclipse battery demand from portable electronics and energy storage systems.

Battery cost decline will augment demand

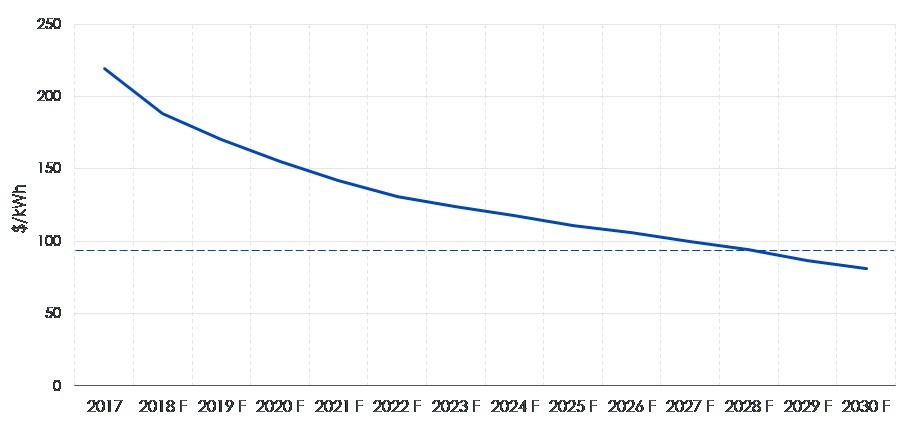

The applications for batteries are becoming larger due to cost declines. Market competition accelerates improvements that lead to reduction in battery prices. Interestingly, the speed of this cost decline has regularly been underestimated. So far, in the past decade we have witnessed an 80% decline in the cost of manufacturing batteries.

Over the next decade, we expect to see another halving in the cost of batteries. According to Wood Mackenzie, 100 kilo watt hour (KwH) is another significant turning point when we expect to see 100KwH cost for battery production, to drive a surge in demand. That’s the point when it will become very economical to implement into more applications.

Figure 2: Costs of batteries are falling and promoting wider usage:

Source: WisdomTree, Wood Mackenzie, forecasts from 2018. Please Note: $100/kWh is considered an important tipping point for battery adoption

Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

For more insights about batteries and disruptive technologies, please visit: The WisdomTree BLOGTo access a list of relevant thematic products within the AJ Bell Youinvest platform, please visit: AJ Bell Youinvest - ThematicsThis material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.