Anindependent report from Scottish consultancy group Biggar Economics suggests underground coal gasification (UCG) could be worth £12.8 billion to the UK economy but investors should not get carried away.

The research was commissioned by UCG play Cluff Natural Resources (CLNR:AIM) up 12.5% to 4.07p following its publication this morning, and also helped by being tipped in the Mail of Sunday on 20 September.

It suggests that Cluff's prospective development on the Kincardine licence alone could have an economic value of £603 million. It is easy to be blinded by these big numbers but there are still considerable hurdles - both technical and regulatory - to be overcome before UCG can be commercially developed.

As Cluff's broker Allenby Capital notes: 'Preparatory work for the Kincardine project continues but CLNR has recently indicated that political uncertainty surrounding energy policy in Scotland may delay filing a planning application. The Biggar report could have a bearing on the broader debate on energy policy in Scotland and indeed the UK.'

You may remember the excitement which greeted the publication of a May 2013 report from the Institute of Directors which suggested UK shale gas production could hit 1,389 billion cubic feet per year and the entry of French oil major Total (FP:PA) into UK shale in January 2014.

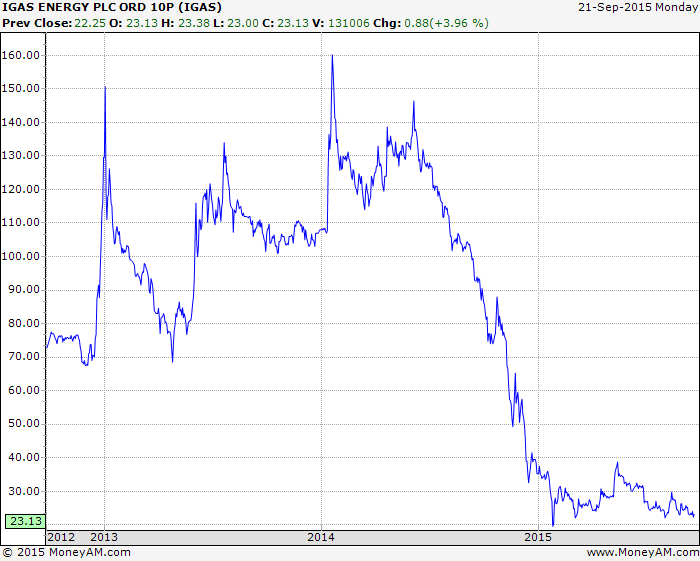

These factors lit a fire under the share prices of the likes of Egdon Resources (EDR:AIM) and IGas Energy (IGAS:AIM) for a spell but the momentum waned as commodity prices collapsed and local opposition pushed the timescales for the exploitation of shale further and further out.