It looks like Blinkx (BLNX:AIM) has lifted poor trading excuses right out of Lord Wolfson's Next (NXT) playbook, blaming the summer for a pretty hefty half year performance miss.

'Trends slowed considerably in the latter half of the first quarter. These trends continued into the second quarter, amplifying the effects of the seasonally slower summer months,' today's trading update states.

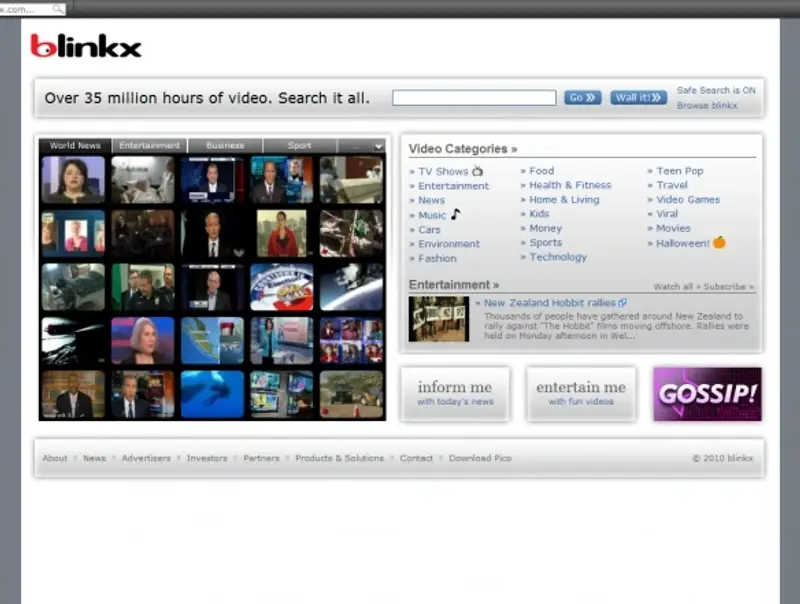

The wording echoes the tone of its July profits warning that sparked a massive 45% sell-off in the shares back then. Falling just the 16% today, to 29.5p, perhaps investors are getting off lightly considering the scale of the half year miss. Blinkx spells out that half year to end September revenues will come in at somewhere between $102 million to $104 million, well down on the $111 million posted in the first half last year, with adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) at approximately break-even.

Compare these figures with the expectations of number crunchers at Numis, who were anticipating EBITDA of $6 million on $117 million revenue. Effectively, profits have been completely wiped out on an 11% sales miss.

'The increased shift to mobile, which currently has a lower gross margin than desktop, will see gross margin fall year on year,' say Numis analysts. But this is a shift companies need to make. 'Mobile is only expected to account for circa 20% of revenues but as we have seen with Facebook (FB:NDQ), companies need to switch to mobile platforms quickly in order to remain relevant,' points out Michael Larner today, an analyst at IT and communications website TechMarketViews.

'The past six months have been transitional for Blinkx, which operates in an evolving industry moving toward emerging mobile models,' states Blinkx CEO S Brian Mukherjee. 'We are well positioned with high-growth advertising formats that are expected to contribute an increasing percentage of revenues,' he adds.

Blinkx also claims to have reached an inflection point, and it's worth noting the sequential month-on-month growth since July, albeit without any financial details to back this up. Could it be that the stock has also hit rock bottom, is the question for investors to ponder. The shares have lost nearly 87% of their value since hitting 218p highs in early January, a collapsed that has wiped more than £600 million off the company's market value.

The group will release interim results on 11 November, and Numis has put its 'forecasts, recommendation and target price under review until then.'