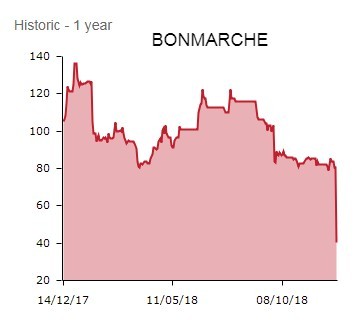

Embattled women’s value retailer Bonmarche (BON) is taking an absolute battering on Thursday, the shares collapsing 36% to 51.5p on a savage profit warning, the week’s latest bit of high street horror news flow following yesterday’s disappointing updates from Superdry (SDRY) and Dixons Carphone (DC.).

Having held annual profit guidance only last month, Bonmarche now bemoans ‘unprecedented’ trading conditions and slashes this year’s £5.5m underlying pre-tax profit (PTP) guidance to a range of breakeven to a £4m loss, a material downgrade which threatens the dividend.

BLACK FRIDAY DISAPPOINTS

Last month, Bonmarche highlighted weak store like-for-like sales and a slow start to the festive selling season, so the latest earnings alert shouldn’t come as a complete surprise to investors.

Sales needed to meet expectations over Black Friday and Christmas in order for Bonmarche to maintain this £5.5m PTP forecast. Sadly, sales during the Black Friday week ended 24 November were ‘extremely poor’, particularly in the Wakefield-headquartered outfit’s retail stores, ‘suggesting that consumer behaviour is not following last year’s pattern, nor the pattern of any year we have experienced previously.’

BLEAKER THAN 2008?

CEO Helen Connolly says ‘the current trading conditions are unprecedented in our experience and are significantly worse even than during the recession of 2008/9. I hope that in the fullness of time, our cut to the forecast may prove to have been overdone, but in the current market, this seems the appropriate stance to adopt.’

Recent unseasonably warm weather blamed for Superdry’s latest warning won’t have helped, but Connolly believes the uncertainty surrounding Brexit is a major factor behind the slump in demand for Bonmarche’s wares and assumes sales won’t improve before the end of March 2019.

Amid the worsening high street crisis, Bonmarche has zero sales visibility, hence the wideness of the guided forecast range, but worryingly, the mid-point implies a 12% slump in store-based like-for-like sales for the third quarter.

DIVIDEND UNDER THREAT

Bonmarche stresses it has adequate cash reserves to meet its liquidity requirements, even at the bottom end of the forecast profit range, and says its intention is to maintain a progressive dividend policy. However, the hard-pressed retailer will review the shareholder reward for 2019 ‘when there is greater clarity about the full year’s result, and the outlook for the clothing market during full year 2020.’

Connolly believes her charge is ‘well prepared to weather the storm’, and insists ‘we can look forward to some recovery in full year 2020. Accordingly, the board remains confident in the strategy, and in the company’s long-term prospects.’ Given today’s share price mauling, investors are far less confident about Bonmarche’s future prospects.