Online fashion retailer Boohoo (BOO:AIM) delivers strong results for the year to 28 February with sales up 48% to £857m and EBITDA (earnings before interest, tax, depreciation and amortisation) up 49% to £76.3m.

New chief executive John Lyttle cheered the ‘excellent’ financial and operational performance and believes the company is ‘well positioned to disrupt, gain market share and capitalise on what is a truly global opportunity’ in e-commerce.

READ MORE ABOUT BOOHOO HERE

Today’s results confirm the positive trend the company reported back in January with both the core boohoo platform and recent acquisitions contributing to the strong group performance.

Sales for the boohoo brand rose 16% to £435m thanks mainly to market share gains in the UK. By increasing its range of sizes and adding hundreds of new styles daily the brand has improved its ‘customer reach’, and the new boohooMAN range has reportedly gone down well.

With the average number of orders per customer and the number of items per basket unchanged, the key to driving sales is gaining new customers which the brand has done with a 9% increase in active users in the last 12 months.

Meanwhile better stock control means that the gross margin (sales minus the cost of sales) increased to 52.9% from 51.2% over the course of the year.

OH YOU PRETTY THINGS

Growth at the Pretty Little Things (PLT) brand, 66% owned by Boohoo, was even more impressive with sales up 107% last year to £374m.

According to the statement ‘all territories delivered strong growth and significant increases in market share and it is clear that there is both the demand and the potential for this to continue’.

The gross margin at PLT is higher than the boohoo brand at 56.6%, up another 1.4% last year, meaning it now contributes almost as much in terms of gross profits as the core business.

Moreover, having relocated PLT’s distribution centre to Sheffield and increased capacity and efficiency at the Burnley distribution centre, the company believes that sales and margins for both brands can keep growing.

KIDS IN AMERICA

The smallest of the group’s brands, Nasty Gal, which was acquired in February 2017, grew sales by 96% last year to £48m thanks to strong growth in its home market of the US.

The product range is priced at a premium to the boohoo brand, which is reflected in its higher gross margin of 56.7%.

North America is a key market for the group and US sales for all three brands increased by 79% last year, well ahead of growth in the UK (37%) and higher than continental Europe (74%).

HOW MUCH GROWTH IS PRICED IN?

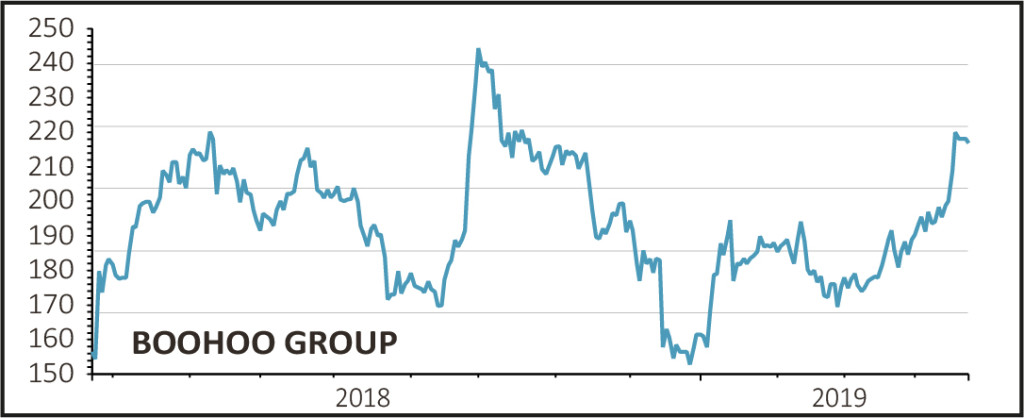

Shares in Boohoo are up 3.5% to 225p on today’s results although they have had a very strong run since the start of the month.

While from an investor’s point of view pure online retail is more attractive than traditional bricks and mortar retail, that is clearly reflected in the valuation of stocks such as boohoo.

At the current price the shares trade close to 42 times earnings for the year to February 2020 and an enterprise value (EV) to EBITDA multiple of 25 times.

Trading so far this year has been ‘encouraging’ but sensibly the company is forecasting less spectacular growth than last year: sales are seen increasing by 25% to 30% while the EBITDA margin is seen steady at 10%.

The medium-term guidance is for 25% annual sales growth with a 10% EBITDA margin so it may be that the shares have already discounted a lot of the good news.